Can you qualify for a home mortgage loan with bad credit?

| FACT: The mortgage and credit crisis which exploded onto the scene in 2007 has eliminated bad credit and bruised credit mortgage loans. Lenders simply don’t offer bad credit sub-prime home loans anymore. |

What’s Your Credit Score?

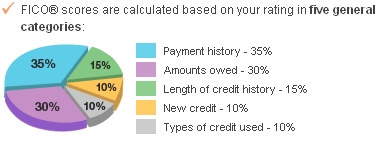

Every lending facility uses guidelines to determine your credit worthiness. Upon reviewing your application, you’re given a credit grade and a determination regarding your loan’s approval or denial. Lenders DO NOT give loans to those with bruised credit anymore. If you are denied by a one lender, contacting 10 more probably won’t help. Click here for some general criteria used within the lending industry to determine credit.

What credit score do I need for a home loan?

Generally speaking, in today’s mortgage world, if your middle credit score is below 640, it is very unlikely that you will qualify for home loan financing no matter what anyone tells you or you see elsewhere on the internet. With a score below this level, you really should save yourself the hassle. Stop attempting to find mortgage loans, and work on improving your scores instead.

Review your credit score?

If you are not sure what your credit score is, you should officially find out. Apply for the mortgage loan, and let the mortgage lender review your exact situation. DON’T ASSUME YOU CAN’T QUALIFY!

CREDIT PROBLEMS & ANSWERS

Late Payments

If your credit has multiple RECENT 30, 60, or 90 plus day late payments, you probably won’t qualify. Especially if those late payments occurred LESS THAN than two years ago. Lenders want a clean recent payment history. Check HERE for some general criteria used within the lending industry when you have late payments.

If your credit history indicates unpaid collection accounts, most “A” grade loan lenders will require these amounts to be paid off before the loan is funded. FHA typically will ignore them if they are under $500, and more than 2 years old. Medical collection “usually” are ignored. Judgments’ (you got taken to court & lost), are almost always REQUIRED to be paid off before approval.

Bankruptcy & Foreclosures

If your income-to-debt ratios are too high, you can either reduce your personal debt (i.e., pay down your debt), obtain a debt consolidation loan, pay down your debt with funds from the sale of personal assets (boat, camper, etc.), select a lower interest rate ARM loan, or add a co-mortgagor.

Is a debt consolidation loan for you?

If you have any late payments on your record, part of the reason may be because of high credit card debt. If you qualify, you can pay off all of your high-interest credit cards into a low debt reduction refinance loan which may be tax deductible (unlike credit cards, which are NOT tax deductible).