CREDIT SCORE TIPS

Are you making this credit score mistake?

Many people believe that running up credit card balances, then making on time payments or paying it in full each month will build higher credit scores. This is a MYTH!

You don’t need to carry a balance or use your card in order to build credit.

This pervasive myth usually gets said around a dinner table or past among friends, and of course is all over the internet – but is a terrible piece of advice — especially if you have bad credit to begin with.

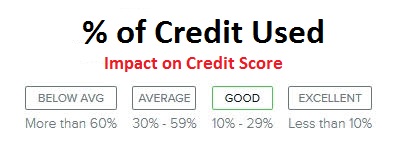

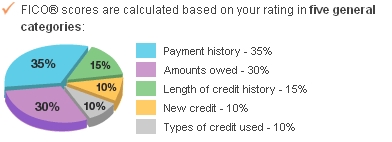

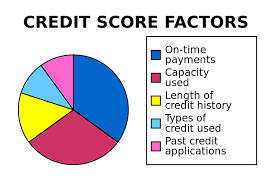

Carrying a balance says you have credit, need the credit, and are unable to pay off the balance. This is considered poor utilization of credit, and results in bad credit and lower credit scores.

Carrying very little balance, or better yet, no balance, says you have credit available, hardly ever use it, and can pay if off quickly – Which are all GOOD traits and result in good credit and better scores.

You should never carry a balance if at all possible, pay down as much as possible each month if you must carry a balance – and never ever have a late payment under any circumstances to have rock’in credit scores.

When the time comes to buy a home, you want the highest credit scores possible to get access to the most programs and the best interest rates.

Contact our Mortgage Experts at (651) 552-3681 of apply online at www.MortgagesUnlimited.biz