The days of the easy money, and just about everyone getting a home loan are long gone. Today, mortgage lenders are required to prove and document your ability to safely afford the house payment, and show that you are responsible with OK or better credit.

So you’ll usually need these things in order to get a home mortgage loan:

- Enough money for the Down Payment (3% is realistically your minimum)

- Two years of good steady employment

- OK or better credit score (640 or higher is your target)

- Monthly income that’s about 3 times higher than your expected monthly mortgage payment

- Keep your debt low (especially credit card balances)

- Any major negative item be OLD (bankruptcies, foreclosure)

Don’t meet that basic criteria today? Consider these additional options.

- Down payment assistance is potentially available (You still need a few thousand dollars MINIMUM).

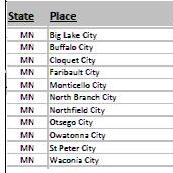

- No Down payment is possible if you are US Military (VA Loan) or want to buy a home in a rural area (You still need a few thousand dollars MINIMUM)

- Apply anyway. Don’t assume you can’t get a mortgage. There may be a loans option. Even if it is a not today, they can let you know where your deficiencies are so you can work towards qualifying in the future.

- Use a Mortgage Broker. A mortgage broker represents lots of different lenders, not just the offerings of one bank. They simply have more options than banks and credit unions.

- Get a co-signor. See if a family member or very close friend with a higher income and better credit than yours will cosign a loan for you.

- Lack of Down Payment. Many program allow you to get a gift for down payment from your family. You can also borrow money for down payment from your 401k

- No proof of income? True no proof of income loans don’t exist anymore, but you can possibly get a non-conforming loan by using your bank statement deposits as qualifying income. These loans come with higher interest rates, so you should always try for a traditional loan first.

Plan for the future.

Even if you can’t buy a home right now, one fact I know, is if you do nothing, nothing will change. If you understand the guidelines and work at it, there is no reason why anyone can not be a home owner in the not too distant future.