New FHA Streamline Refinance Rules

St Paul, MN: Home owners with an existing FHA mortgage loan – rejoice. Washington has announced new guidelines to make it cheaper and easier for homeowners to refinance FHA mortgages. The reason is pretty simple – since FHA already backs your mortgage, they’re the ones who are on the hook if you default. So if refinancing will help make your mortgage more affordable for you, it makes sense for them to help.

St Paul, MN: Home owners with an existing FHA mortgage loan – rejoice. Washington has announced new guidelines to make it cheaper and easier for homeowners to refinance FHA mortgages. The reason is pretty simple – since FHA already backs your mortgage, they’re the ones who are on the hook if you default. So if refinancing will help make your mortgage more affordable for you, it makes sense for them to help.

The updated guidelines apply to FHA Streamlined refinancing, which is about as close to automatic loan approval as any refinance program can get. There are many variables to the program, but under the best circumstances, you don’t even need an appraisal, making it a great loan for underwater home owners.

Reduced FHA Fees

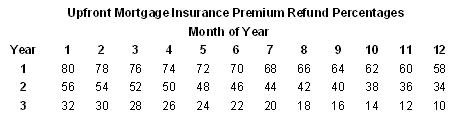

The changes announced dramatically reduce some of the fees usually charged for FHA mortgages and refinancing. FHA loans have two major mortgage insurance parts. The upfront fee, and the monthly mortgage insurance. For refinances starting June 11th 2012 and after, the current upfront fee of 1 percent of the loan amount is being reduced to a mere 0.01% – equal to $10 on a $100,000 mortgage – while the annual insurance premium is being cut by more than half, to 0.55 percent of the balance, down from 1.15 percent currently.

The administration estimates the reduced annual fee will save an additional $95 a month on a $175,000 mortgage, on top of the actual savings from refinancing to a lower mortgage rate.

Anyone can with an FHA mortgage can refinance at anytime, but to qualify for the reduce fees, you must have obtained your current FHA mortgage prior to June 1, 2009.

Home Lost Value?

The FHA streamline refinance option that does NOT require an appraisal is a great option for homes that have lost value. Homeowners can be underwater on their FHA mortgage (i.e., owing more than their home is worth) and still qualify for refinancing. In fact, there’s no limit on how far underwater a borrower can be and still get an FHA Streamline Refinance.

If you’re underwater, but have a second mortgage or HELOC (home equity line of credit) – you’ll have additional challenges – so be sure to speak with a good licensed loan officer to determined your exact situation.

Bottom Line

FHA does not do loans. Lenders do loans that FHA insures. Although FHA has pretty generous guidelines for refinancing, it’s still the lender’s call on whether to refinance or not. Some lenders will have tighter guidelines, and some may even refuse to refinance a mortgage even if it appears to meet FHA requirements. The new guidelines remove some of the obstacles that sometimes make lenders reluctant to do an FHA streamline refinance, by taking such loans out of the formula used to assess their performance as FHA approved lenders. Since many of these mortgages are considered somewhat riskier than more recent home loans, some lenders have been reluctant to refinance them for fear of damaging their rating with FHA.

To see if you can obtain an FHA mortgage refinance, check with your local approved FHA mortgage lender.

SPREAD THE WORD WITH THE SOCIAL MEDIA LINKS BELOW

.

While mortgage rates have risen a bit, there are still millions of people who could take advantage of the program to save significant money on their monthly mortgage payments. Because of this, the FHFA had Fannie Mae and Freddie Mac extend the HARP program by two years to December 31, 2015. The program was originally set to expire December 31, 2013.

While mortgage rates have risen a bit, there are still millions of people who could take advantage of the program to save significant money on their monthly mortgage payments. Because of this, the FHFA had Fannie Mae and Freddie Mac extend the HARP program by two years to December 31, 2015. The program was originally set to expire December 31, 2013.

St Paul, MN: Many homeowners are curious about the appraised value of their home in today’s market. An actual appraisal is expensive, and county tax records do NOT always reflect true market value. As you may be aware, home values are constantly fluctuating, and with the decline in average values, it is important to have an accurate idea of what your home is worth.

St Paul, MN: Many homeowners are curious about the appraised value of their home in today’s market. An actual appraisal is expensive, and county tax records do NOT always reflect true market value. As you may be aware, home values are constantly fluctuating, and with the decline in average values, it is important to have an accurate idea of what your home is worth.