Minneapolis, MN: Current mortgage interest rates are hovering just a hair above historic lows. So why are record number of home buyers not buying?

So do interest rates really matter? Sure, they’re are a very big key component in a person’s decision to buy because of the borrower’s monthly mortgage payment. And often the first conversation between a real-estate agent and a potential buyer —”How much are you willing to spend?”— can be influenced quite a bit by mortgage rates.

Given the initial desire to buy a home isn’t purely rate-driven, home buyers must weigh what’s for sale, their family and job situation, what the payment might be, etc. It could take a while to see what effect, if any, the recent drop in interest rates has on demand for homes… But lower interest rates, as the word spreads, should increase demand for homes.

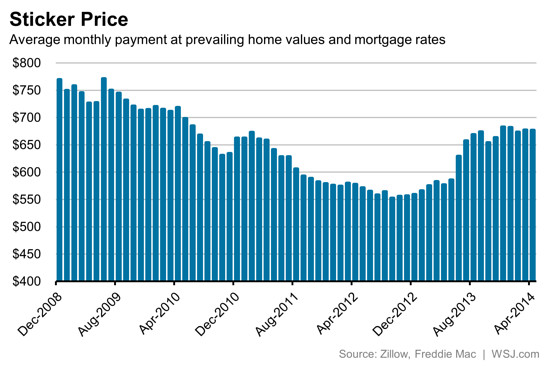

What does this payment picture look like right now? The monthly payment on the loan itself (not including taxes and insurance) on the median-priced U.S. home fell from $673 in February 2011 to $552 in September 2012 as interest rates fell.

Interest rates stayed low through May 2013, but the average payment rose to $586 as home prices ticked up. (These calculations assume a 20% down payment on the national median home value as calculated by Zillow).