First Step for a First Time Home Buyer

Minneapolis, MN: Congratulations, you’ve decided that you would like to own you own home. As a first time home buyer, what should be your first step to home ownership?

Consult a Local Mortgage Loan Officer

The vast majority of people, in my opinion, start the process wrong, by talking to a real estate agent first. Without fail, the number one step to home ownership is to talk to a local mortgage company Loan officer. Why? Simple. How else do you know what you can afford, what mortgage programs are available to you, or how much cash you’ll need to pull it all together otherwise?

The vast majority of people, in my opinion, start the process wrong, by talking to a real estate agent first. Without fail, the number one step to home ownership is to talk to a local mortgage company Loan officer. Why? Simple. How else do you know what you can afford, what mortgage programs are available to you, or how much cash you’ll need to pull it all together otherwise?

When talking to a real estate agent first, you are already off on the wrong foot. A real estate agent job is to find you the right house… But without knowing what you can afford, how can they show you anything? Any good real estate agent knowing you are not already pre-approved by a lender is simply going to refer you to a Loan Officer to figure out your financing. You might as well go there first.

Many people think they will be approved, and have an idea of what they can afford – and most of the time they are correct. Sadly, a lot of them who think they can be approved, simply can not. Another misconception is that if you have an OK credit score, that you will be approved. Credit scores are a great start, but credit scores alone do not make for a loan approval.

What Mortgage Company to Choose?

The mortgage company you choose equals about 20% of the success in getting a home loan, The Loan Officer you choose equals the other 80% of the success. For the most part, almost all mortgage companies offer the same basic loan programs. Conventional loans, FHA Loans, VA Loans, USDA Rural Housing Loans, first time home buyer, and down payment assistance programs. Furthermore, all mortgage companies have essentially the exact same closing costs and interest rates. So shopping around based on those parameters doesn’t get you too far.

Your Loan Officer on the other hand is essentially the primary figure and nucleus of the entire transaction. Their knowledge and expertise in loan programs, underwriting guidelines, and communication skills between all parties can not be overstated. Your Loan officer works with everyone, from you the buyer, to both the selling agent, your buying agent, processors, underwriting, title company, appraiser, and more. Having a new, weak, unlicensed, or inexperienced Loan officer can cause all sorts of problems.

Licensed versus Unlicensed Loan Officer

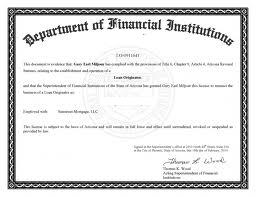

Most people don’t even realize there is a difference, yet a whopping 80% of Loan Officers are NOT licensed. Clearly if most people knew there was a difference, they would only work with a licensed loan officer. Licensed loan officers need to have successfully completed mortgage education, passed stringent Federal and State testing, completed criminal background checks, and are required to attend continuing education classes each year. Non-licensed, but simply registered loan officers do not need to do any of those items.

Verify a Loan Officer is Licensed

Luckily, there is a national database where you can check to see if the person you are working with is simply registered, or fully licensed. Go to www.NLMSConsumerAccess.org. Type in the Loan Officers name or registration number (NMLS number).

Once there, look at the bottom of the page. If is says State Licenses/Registration and lists one or more states, this person IS Licensed. If it says Federal Registration, then Federal Mortgage Loan Originator, this person is NOT Licensed