USDA loan property eligibility map changing for 2015

The very popular no down payment home loan for rural areas of the country is changing slightly for 2015 throughout the country.

“USDA Announcement (posted 12-22-14) indicates President Barack Obama signed the Consolidated and Further Continuing Appropriations Act of 2015 (omnibus spending bill) into law last Tuesday.

“USDA Announcement (posted 12-22-14) indicates President Barack Obama signed the Consolidated and Further Continuing Appropriations Act of 2015 (omnibus spending bill) into law last Tuesday.

While it is long and boring to read, the most important aspect is that USDA loans will implement new property location eligibility maps on February 2nd, 2015.

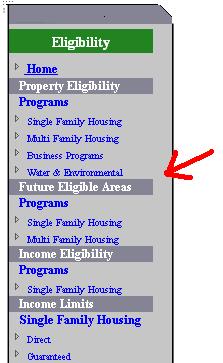

The changes will be those already published on the ‘Future Eligible Areas’ maps posted on the USDA eligibility website (USDA Future Eligible Maps), which had be previously announced to go into effect, but had been delayed multiple times.

When checking property eligibility for a USDA loan, be sure to click the future eligibility link, as only applications completed and submitted to the USDA on or before Feb 2nd, 2015 are eligible under the current eligible areas.

Completed applications submitted by your mortgage lender to USDA after Feb 2nd will be subject to the new ‘Future Eligible Areas’.”

Another reminder about USDA loans is that you can apply with any participating USDA loan lender. You do not need to find or use an actual USDA office. We provide USDA loans in MN, WI, or SD