With today’s super low mortgage rates, many people are looking to refinance or buy a home. Everyday, they call lenders and ask “What is your rate.” A seeming logical question to ask – but the reality is, the #1 most important aspect of a successful mortgage transaction is the quality of the Loan Officer.

When selecting a Mortgage Loan Officer, most people mistakenly call their local bank first and assume the banks have hired qualified people. The reality is, most banks hire relatively new, and have low paid people as mortgage loan officers. Bank Loan Officers are NOT required to have any education, nor do they have to pass any sort of mandatory state or federal tests to be labeled a loan officer. Many of the big banks staff their 1-800 phone numbers with temps. Yes, you heard me – temps!

The secret to selecting an expert is a combination of experience and training.

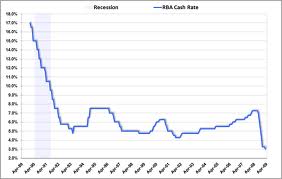

An experienced Loan Officer can help you understand the entire mortgage process and will be able to determine the best loan for you based on your individual goals. The right loan for someone who plans to stay in a home for three years and who has increasing income, may not be the right loan for someone who wants to have the loan paid off within 15 years and can afford a higher payment. The first borrower may find a five year adjustable rate mortgage the best option, while the second borrower may realize a 15 year low fixed rate mortgage matches her needs best.

Many borrowers find the mortgage process very frustrating. They feel they are kept in the dark about the process and problems that arise which cause delays. An experienced Loan Officer does not over promise, but rather explains the type of problems you may experience and the solutions to those problems. By keeping you informed and protected, an experienced loan consultant reduces your stress.

A poor inexperienced application clerk (loan officer) may suggest you fudge information on your loan application, or may not get a complete application out of laziness. The more complete and accurate your loan application is from the beginning, the faster and smoother your loan underwriting will be. The industry has evolved to the extent that fraudulent or misleading information is almost always uncovered by fraud alert systems that scrutinize employment and residency information. You are required to be honest in completing a loan application. Do not do business with any loan officer who tells you otherwise.

Lastly, an experienced loan officer can explain how closing costs and interest rates are dependent on one another. The more fees you are willing to pay, the lower your rate. The less fees you are willing to pay, the higher the rate. Many loan officers will tell you they have the best rate only to surprise you with unreasonable closing costs. It is best to work with a loan officer who explains all of your rate options with you, and who will suggest a rate and fee combination that works best to meet your long term goals. The right loan officer will always get an exact title fee quote so that the Good Faith Estimate provided to you is accurate.

Once you’ve started talking with a Loan Officer – verify their credentials. All Loan Officers are required to have and display an NMLS number (Nationwide Mortgage Licensing System and Registry). Go to www.NMLSConsumerAccess.org, and type in your Loan Officers name or number.

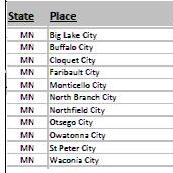

You can see their employers, and work history – but more importantly, you can see if they are simply a registered but unlicensed Loan Application Clerk, or an actual Licensed, and Tested Loan Officer. It is a bit trick to tell, but at the very bottom of their NMLS information page, it will say one of two things:

1) Federal Registration – then Federal Mortgage Loan Originator. This person is a unlicensed application clerk

2) State Licenses / Registrations – They list one or more individual state licenses. This person is licensed and tested both Federally, and in each state listed.

For the largest financial transaction of your life, it is smart to NEVER WORK WITH JUST AN APPLICATION CLERK

The

The  How Does It Work?

How Does It Work?