Minneapolis, MN: Every year, millions of potential new home owners ask the question, “can I qualify for a mortgage?” It’s a scary question for many people, but getting the answer isn’t anywhere as hard or difficult as people think.First, ask yourself some of these basic questions, then contact a local licensed non-bank lender and fill out an application. There are no obligations to let a lender review your situation.

Can I afford the payment?

Can I afford the payment?

This is obviously a major questions. I always tell people if they have been comfortably making a rent payment similar to what the anticipated mortgage payment will be, you’ve passed this test!Many people on the other hand have “payment shock”, which simply means the new home payment will be significantly more than what the pay now, if anything.

Lender use a term called “debt ratio”, which is simply a measure of a percentage of your income that would go towards the house, and all other debt. There are two different ratios they measure. The first number is your “housing debt”, which they don’t like to see over 28%. This is a measure of just the cost of the house {principal, interest, taxes, insurance) versus your income. The next number, which most people are more familiar with is your “total debt ratio”, takes in all debt. The house payment, car payments, credit cards, student loans, etc. This number they generally do not like to see over 41% of your income.

There are slight variations to these ratios depending on loan program, so be sure to consult your Licensed Mortgage Loan Officer for details. Here is a link to some popular mortgage calculators to help you determine debt ratios.

Down Payment

Mortgage lenders love it when you put at least 20% down. That down payment size or more will get you a loan without mortgage insurance, a nice money saver. Realistically many people simply can’t afford that much. Conventional loans may be available with as little as 5% down, and the very popular FHA Loan is available with as little as 3.5% down payment. The minimum down payment can also be effected by credit score. Someone with a 660 credit score for example, will need at least 10% down on a conventional loan, while someone with a 720 score will only need 5% down.

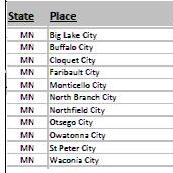

Zero down payment is a potential option for some people. Military veterans can possible obtain a zero down payment VA Loan, and those seeing to live in rural areas of the country may also qualify for a no down payment USDA Rural Development Loan.

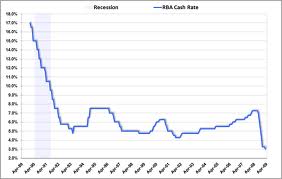

Your down payment will also affect your interest rate. All other things being equal, the best interest rates go to borrowers who put down larger down payments; you’ll pay a somewhat higher rate if you put down only 5 percent or 10 percent.

Credit score

Credit scores clearly are a major factor, but it is actually pretty simple. If you have great credit (over 720), you’ll have no problems. If you have OK or average credit (660 – 720), you’ll likely qualify for most programs, but not necessarily all, or not with the best mortgage interest rates. If you have bad credit (below 620), you will not qualify for anything, and should work on repairing your credit before attempting to get a mortgage loan.

To review your credit go to www.annualcreditreport.com. You can get a copy of your report for free once every year. This service does NOT include scores. Another free option is http://www.creditkarma.com. This DOES include scores, but they offer similar, but not the actual FICO scores lenders use, so your numbers may be different than what a lender gets, but at least it gets you an idea of where you are at.

Your Income

To qualify for a mortgage loan, you will be required to fully document all of your qualifying income. Lenders want to see your past two-years job history. Do not confuse this with needing to be at the SAME job for two-years. It is OK if you’ve changed jobs.

If you’re self-employed, get commission, or tipped income, it’s another story. You’ll need to be at the same position for at least two-years, and provide the past two-years Federal Tax returns. Your income is based on your AFTER deductions. If your income is stable, or increasing, you’re in great shape. If your income is declining, this may be an issue.

Income from child support, alimony, social security, pensions, etc, are all acceptable. You’ll need to fully document what is is, and that you are actually receiving it. You will also need to prove it will continue for at least three years.

Bottom Line

If you feel you meet these basic requirements, contact a local licensed Loan Officer to submit an application. Before you do, understand who you should contact, and some of the myths:

- 80% of Loan Officers are unlicensed application clerks. Only deal with a licensed Loan Officer. Learn How.

- Your Bank doesn’t know you or care about you

- Credit Unions DO make a profit

- Get off the Internet. There are no deals there you can’t get locally – Sit down with a LOCAL Lender

An original article by Joe Metzler (C) 2012 Metzler Enterprises, LLC for www.MnRealEstateDaily.com

USDA announced last month that it was lowering its upfront mortgage insurance premium fee to 1 percent of the total mortgaged amount, down from the current from 2.75 percent. This amount is added to the borrowers loan. So someone today borrower needing a $100,000 loan would actually have a $102,750 loan. Under the new guidelines, the same borrower would have a $101,000 loan.

USDA announced last month that it was lowering its upfront mortgage insurance premium fee to 1 percent of the total mortgaged amount, down from the current from 2.75 percent. This amount is added to the borrowers loan. So someone today borrower needing a $100,000 loan would actually have a $102,750 loan. Under the new guidelines, the same borrower would have a $101,000 loan.