Senate bill S.1375, the “Rebuilding American Homeownership Act” has been introduced by Senator Jeff Merkley, D-OR to try and expand the existing HARP (Home Affordable Refinance Program”.

Senate bill S.1375, the “Rebuilding American Homeownership Act” has been introduced by Senator Jeff Merkley, D-OR to try and expand the existing HARP (Home Affordable Refinance Program”.

This has been called by many as “HARP 3“, and is designed to allow loans not currently owned by Fannie Mae of Freddie Mac to be refinanced through the HARP program.

Under the current HARP underwater refinance program, in order to qualify, your existing mortgage loan must be owned by Fannie Mae or Freddie Mac.

If passed, the bill would force Fannie Mae and Freddie Mac to refinance non-Fannie Mae or Freddie Mac loans, and to price in the additional risk into the interest rate so that the program would not cost taxpayers anything.

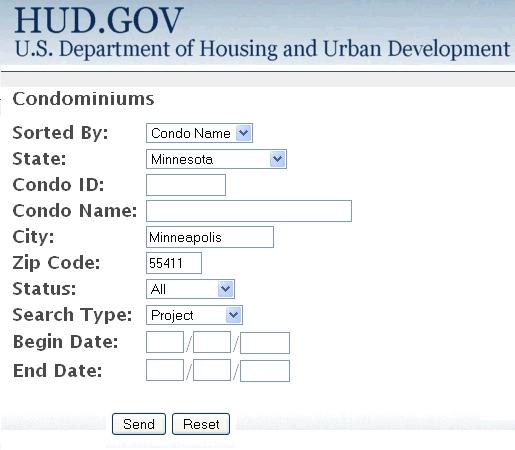

DO I QUALIFY FOR HARP?

Merley was quoted as saying the “It shouldn’t matter which financial institution owns a loan…” and that “all responsible homeowners should have the option to refinance and save money.”

Merkley also introduced another bill that would encourage people to refinance into loans terms of less than 20-years, which builds equity faster, by paying $1,000 of underwater homeowners closing costs.

Previous attempts at a HARP 3 program, or modifying the current HARP 2 program have not gain much traction in Washington, and these two new bills have no other sponsors.

Less homes for sale than what we’d like to see, combined with fewer foreclosures, and low mortgage rates continue to fuel these price increases. New listings were up in June by over 20% from last year, but still there are more buyers than sellers, sparking competition amongst buyers.

Less homes for sale than what we’d like to see, combined with fewer foreclosures, and low mortgage rates continue to fuel these price increases. New listings were up in June by over 20% from last year, but still there are more buyers than sellers, sparking competition amongst buyers.