St Paul, MN: If you surf the cable TV channels, listen to talk radio, or search online, you will find numerous financial and debt management experts offering tips and tricks on managing debt such as mortgage, credit card debt, student loan and so on.

However, it is important to evaluate one’s own personal financial situation before implementing any such debt relief tips. This is to ensure that you benefit from such advice and not further pile up debts that you become responsible for. So, here are 5 strategies to repay your Minnesota mortgage faster.

However, it is important to evaluate one’s own personal financial situation before implementing any such debt relief tips. This is to ensure that you benefit from such advice and not further pile up debts that you become responsible for. So, here are 5 strategies to repay your Minnesota mortgage faster.

Make Extra Payments: If there is no pre-payment penalty, you can make extra payments on the mortgage loan. The extra amount of money is taken off from the principal mortgage amount. For example, a $400,000 loan at 4% rate for 30 year fixed will pay off in only 25 years if you make $200 extra payment every month.

Make Bi-Weekly Payments: Bi-weekly payments on Minnesota mortgage loans are better than a monthly payment. In doing so, at the end of the financial year, you are paying one month extra payment. Therefore, the extra month’s payment will shorten the term of the mortgage. Every penny counts when you’re repaying any sort of debt. For example – Using the same numbers as above, by making bi-weekly payment you would pay off the loan is 25.8 years instead of a regular 30 years.

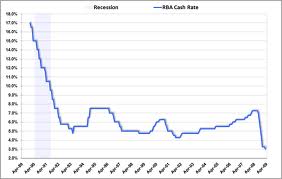

Get a shorter-term refinance loan: This financial strategy has gained in popularity among the borrowers in Minnesota. The rate of interest has nose-dived and it is much simpler for the homeowners to repay their mortgage debts. The advantage of this refinance loan is that by paying high monthly payments you pay off the loan in considerably shorter period of time. For example – Instead of taking a regular 30 Year Fixed mortgage, consider taking a 20, 15 or a 10 year mortgage. If you can afford the payment, you save on interest cost and also pay off the loan much quicker. A few mortgage lenders even let you pick whatever mortgage amortization term you want, from 8 – 30-years. For example, if you have only 12-years left, you can get a new 12-year mortgage loan.

Make a One Time Big Payment: If you get inheritance, gift or a big bonus, you can make one large lumpsum payment. That will reduce your principal balance substantially and thus pay off the loan quicker. You can also ask the lender to “recast” the loan and reduce the monthly payment without refinancing. Don’t just make the extra payment. Talk to your lender first.

The ideas mentioned here are not meant to be a tax advice. You are encouraged to contact your CPA/Financial Adviser before making any significant money decision.

The

The  How Does It Work?

How Does It Work?

Mortgage Rates are at Historic Lows. Start saving money now on your VA Home Loan!

Mortgage Rates are at Historic Lows. Start saving money now on your VA Home Loan!