Minneapolis, MN: No one likes having dings on their credit report, but let’s face it, sometimes it is impossible to avoid. When credit dings happen, it is important to work on getting back into the credit good graces, as it effect so many things in your life, from ability to get a mortgage loan, the interest rate you pay on mortgage, credit cards, car loans, and even you paying more for your car insurance.

Next to basic late payments, small collection accounts are some of the most common negative item we see on credit reports. We see a lot for medical items, and old utility bills. We see a lot over disputes with a company that never got resolved.

While some of theses collection accounts may be small, and even long forgotten, they can be real credit score killers.

The main things you need to know about collection accounts

First, is that simply paying them off doesn’t mean they go away. It still happened, and it is still on your credit report. You can always try to leverage paying the creditor contingent on having the creditor completely remove the item from your report, and sometimes this works. I suggest everyone at least try it. But there is nothing mandating a company remove the negative item once paid.

Paying them off also doesn’t magically improve your credit score like people think. You should usually see at least a small improvement to your credit score, especially if the account being paid is a more recent collection account.

If the collection sits on your credit report for a really long time, and you now pay it off, you may temporarily LOWER your credit score because you may have turned the DLA, or Date of Last Activity to a current date. The basic premise being that the older a negative item is, the less it hurts your score. By paying it off, the account for example went from 5-year old unpaid account (which still hurts), to a one month old paid collection, which may hurt more because it is now recent activity.

Most credit repair experts will tell you to pay off collections starting at the newest account, and working back to the oldest, and that sometimes, it is best to just leave an old account alone.

Over time, it is ALWAYS better to pay a collection account. An unpaid collection account hurts credit more and longer than a paid collection account.

Finally, while some unpaid bill becoming collection may be inevitable, most collections are avoidable. Dealing with the situation up-front is best so it never becomes a collection account. I understand the frustration of a medical bill that should have been paid by insurance, and fighting with the hospital or clinic. But ignoring it doesn’t make it go away, and it will probably come back to haunt you years later.

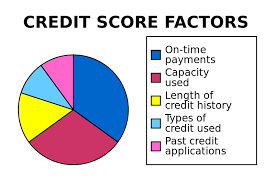

The biggest item people need to understand is that a huge portion of their credit score is based recent information versus old information. A 30-day late payment on a car loan from 5-years ago DOES show up on your credit report, but it has little impact compared to a 30-day late payment from last month.

The biggest item people need to understand is that a huge portion of their credit score is based recent information versus old information. A 30-day late payment on a car loan from 5-years ago DOES show up on your credit report, but it has little impact compared to a 30-day late payment from last month.