What is the Lender Criteria for Approving Home Mortgage Loans?

Buying a home is a dream for most Americans. The process is time consuming, paperwork intensive, and can seem overwhelming to many people. The reality is that the process, like anything other unknown in your life, really isn’t as bad as the hype.

Essentially the mortgage lender is going to check you out, evaluate your risk, and decide if they they are going to give you the loan. It is important to understand how credit institutions evaluate home loan applications and what is required to ensure easy loan approval.

Loan Documentation

The first thing the lender needs is your basic application.  You can provide that in person, over the phone, or with a secure online mortgage application. Next will be a review of your basic documentation to verify and back up what you supplied on your application. If you said you make $60,000 a year, great, prove it with the last 30-days of pay stubs, the last two-years W2’s, and your federal Tax Returns. If you said you have $20,000 in the bank for down payment, great. Prove it by supplying your last two months bank statements.

You can provide that in person, over the phone, or with a secure online mortgage application. Next will be a review of your basic documentation to verify and back up what you supplied on your application. If you said you make $60,000 a year, great, prove it with the last 30-days of pay stubs, the last two-years W2’s, and your federal Tax Returns. If you said you have $20,000 in the bank for down payment, great. Prove it by supplying your last two months bank statements.

Pretty straight-forward so far. But each person is different, so you may need other documentation. Recently divorced? Provide your divorce decree. Receiving alimony, child support, social security, pensions, disability, or other sources of income. No problem, but again, prove it with the appropriate supporting documentation. Have an old bankruptcy? We’ll need a full copy of your bankruptcy papers, including the discharge notice. Have an old foreclosure or short sale? We’ll need the paperwork to verify the date.

Once all this is established, we can determine loan eligibility.

Income to Debt Ratio’s

Debt-to-income ratio’s, or DTI, is simply a calculation of how much money do you make, and how much would the new home itself cost as a percentage of your income. We also look at any other existing debt, then determine what the new house and existing debt would equal as a percentage of income. If these numbers are too high, you’ll be denied because you are stretching yourself too thin.

DTI is one of the major deciding factors for your loan application. To understand how a loan application gets reviewed, here is a sample:.

Two individuals, Bob and Mary apply for home loan of $200,000. Bob makes $40,000 a year salary, and Mary makes $30/yr, full time. This equals about $60,000 a year. So adding those two, their combined qualifying income is $100,000 yr, or $8333 a month before taxes.

Bob has a car loan of $300 a month, and one credit car, with a minimum monthly payment of $50 a month. Mary also has a car payment of $275 a month, a $50 a month student loan, and credit card with minimum payment of $75. All this debt equals $750 a month. For most loans, mortgage lenders do NOT look at utilities, car insurance, day care, etc. Just the items that show on your credit report.

The house they want to buy is $300,000. They plan on putting a large down payment of 20% ($60,000). Factoring in paying back $240,000 at 3.50% interest, homeowners insurance of $1320 a year, and property taxes of $3600 a year. Their monthly payment would be $1497.

The house payment works out to be 17.9% of their monthly income (housing ratio), and with there $750 in other debt, their total debt ratio is $27%. Both of these numbers are below maximum debt-to-income ratio’s, so Bob and Mary are in good shape. They are buying a home they can safely afford.

Credit Report and Score

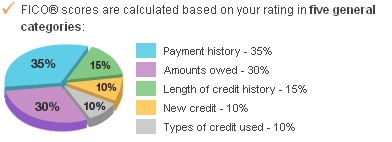

The credit score works as a first impression for the lender, the higher the score, the better is your chance of the loan being approved. Credit scores are not perfect, but generally are a pretty good indicator of your risk.

Poor credit scores, essentially anything below 640, and you should probably not bother applying, and work on improving credit first.

Down payment and Cash to Close

Buying a home is going to require money. Even no down payment loans require some money, especially once you start factoring in closing costs. Mortgage lenders care greatly about you proving the money needed to buy the house. We will look at your last two months bank statements. Did you have the money, did you transfer it from a different account, is it a gift? If you show large non-payroll deposits, expect to be asked, and to prove where the money came from.

The reasoning behind this goes to many items, from fraud, to undisclosed debt. Is that large deposit a gift, or really a loan that you’ll need to make payments on, for example.

The Bottom Line

To sum up, while a high credit score, strong credit history, big down payment, and good income will help in loan approval, they, by no means, guarantee one. Having manageable debt levels also plays an important role. Lenders make money by lending money. We want to give you a home loan. On the other hand, the whole purpose of underwriting is to minimize risk. A home buyer unable to safely afford the home is not good for them or the lender.

You can provide that in person, over the phone, or with a secure online mortgage application. Next will be a review of your basic documentation to verify and back up what you supplied on your application. If you said you make $60,000 a year, great, prove it with the last 30-days of pay stubs, the last two-years W2’s, and your federal Tax Returns. If you said you have $20,000 in the bank for down payment, great. Prove it by supplying your last two months bank statements.

You can provide that in person, over the phone, or with a secure online mortgage application. Next will be a review of your basic documentation to verify and back up what you supplied on your application. If you said you make $60,000 a year, great, prove it with the last 30-days of pay stubs, the last two-years W2’s, and your federal Tax Returns. If you said you have $20,000 in the bank for down payment, great. Prove it by supplying your last two months bank statements.

The biggest item people need to understand is that a huge portion of their credit score is based recent information versus old information. A 30-day late payment on a car loan from 5-years ago DOES show up on your credit report, but it has little impact compared to a 30-day late payment from last month.

The biggest item people need to understand is that a huge portion of their credit score is based recent information versus old information. A 30-day late payment on a car loan from 5-years ago DOES show up on your credit report, but it has little impact compared to a 30-day late payment from last month.