Why do I need mortgage insurance?

When buying a home, and getting a home loan, being approved or not all comes down to risk. If the mortgage company thinks you are a good risk, you get the loan. If you are too risky, you get denied. Pretty simple concept.

A good example of this concept is down payment size. If you put at least 20% down, you are considered a good risk. Put less than 20% down, you are high risk. Needless to say, not everyone can put 20% or more down payment.

To minimize the lenders risk on small down payment loans, but yet allow for these same small and more affordable down payments, a tool called mortgage insurance, commonly referred to as PMI, or private mortgage insurance is available.

The insurance policy you are required to obtain and pay for as part of your monthly mortgage payment essentially provides protection to the lender in case you default on the loan, and covers the lender for the amount between 20% down and what you actually put down.

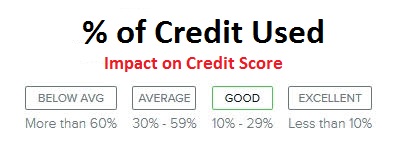

The cost of the mortgage insurance depends on multiple factors, but primarily down payment size, credit scores, and loan type.

The smaller your down payment, the higher the mortgage insurance costs. The lower your credit score, the higher the costs. For example, A client with 10% down and an 800 credit score on a 30-yr fixed loan might pay about $30 a month per $100,000 loan amount for mortgage insurance. The same 10% down, but a client with just a 640 credit score might pay as much as $105 per month per $100,000 loan.

Contact your loan officer for exact monthly costs for your individual situation and down payment size, as this article covers basic and most common situations, but does not encompass every possible situation.

Typicaly standard PMI will automatically fall off your loan once you reach 78% of the original loan amount with no interaction from the homeowner. It is simply automatic.

You can request to have mortgage insurance removed from your loan once you believe you are at 80% of the original loan. The 80% mark can be based on a combination of paying down the loan, and today’s appraised value. For example, you put 5% down when you bought the house, you’ve paid down through payments another 5%, and the home has appreciated 14% since you bought it. That would put you ate 76% loan-to-value. So contact your lender on their proceedure to have mortgage insurance dropped.

Must Deal With Mortgage Insurance

If you are putting down less than 20%, you MUST deal with mortgage insurance somehow. Other than monthly mortgage insurance, lenders can also offer more creative options. The most popular is known as ‘lender paid mortgage insurance’, where the lender increases your interest rate, and uses the extra money to buy mortgage insurance. You still have it, but it doesn’t show as a monthly cost.

The next is known as ‘single premium’ insurance. Under this option, you pay a one time lump sum amount up-front at closing equal to 3-years of monthly mortgage insurance.

The last option, is getting two loans. An 80% first mortgage, and a second mortgage to cover the difference from what you have for down payment. This is a viable option primarily for high credit, low risk clients, and for jumbo loans over $424,100.

While these options may sound enticing, for most people, balancing up-front costs, long-term versus short-term costs, and overall benefits based on individual situations can become a mind numbing challenge. Suffice to say the vast majority of people go with standard monthly mortgage insurance for a reason.

FHA Loan Mortgage Insurance

FHA loans also have mortgage insurance, but this insurance is significantly different from conventional loan mortgage insurance.

Most people using FHA loans put the minimum down payment of 3.50%, and take a 30-yr fixed loan. Most FHA mortgage insurance is the same for everyone regardless of down payment size or credit score. For small down payments, this is roughly $85 per month per $100,000 loan amount. Next, FHA mortgage insurance for small down payments is called ‘Life of Loan’ insurance, which means regardless of future loan-to-value, appreciation, or what you’ve paid down, FHA mortgage insurance never goes away. The only way to remove it is to refinace the loan.

Next, FHA mortgage insurance for small down payments is called ‘Life of Loan’ insurance, which means regardless of future loan-to-value, appreciation, or what you’ve paid down, FHA mortgage insurance never goes away. The only way to remove it is to refinace the loan.

Another item with FHA loans, is that regardless of down payment size, ALL FHA loans will have insurance. So contact your loan officer for exact monthly costs for your individual FHA insurance, especially if you are putting more than 10% down or picking a 15-year loan.

PMI is Not Homeowners Insurance

Mortgage insurance often times gets confused with home owners insurance. PMI protects the lender from default, while home owners insurance protects the owner for items like fire, storm damage, theft, etc.

VA Loans Have NO Mortgage Insurance

If you are active or former U.S. military, you have a great benefit in a VA Home Loan. Most people know VA loans generally do NOT require a down payment, they also have NO monthly mortgage insurance. This can be a huge monthly savings over other loans.

———–

Author Joe Metzler is a Senior Mortgage Loan Officer for Minnesota based Cambria Mortgage. He was named the 2014 Minnesota Loan Officer of the Year, and Top 300 Loan Officers in the Nation for 2010, 2015, 2016. He provides Home Mortgage Loans in MN, WI, IA, ND, SD. He can be reached at (651) 552-3681. NMLS 274132.