Fixed Mortgage Rates Ease Going Into The Labor Day Weekend

Minneapolis, MN: Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates pulling back and following bond yields lower after gradually moving higher over the past month.

News Facts

- 30-year fixed-rate mortgages averaged 3.59 percent with an average 0.6 point for the week ending August 30, 2012, down from last week when it averaged 3.66 percent. Last year at this time, the 30-year FRM averaged 4.22 percent.

- 15-year fix rate mortgages this week averaged 2.86 percent with an average 0.6 point, down from last week when it averaged 2.89 percent. A year ago at this time, the 15-year FRM averaged 3.39 percent.

- 5-year adjustable-rate mortgages (ARM) averaged 2.78 percent this week with an average 0.6 point, down from last week when it averaged 2.80 percent. A year ago, the 5-year ARM averaged 2.96 percent.

Quotes

Attributed to Frank Nothaft, vice president and chief economist, Freddie Mac.

- “Treasury bond yields fell, allowing mortgage rates to follow, after the release of the July 31st and August 1stminutes of the Federal Reserve’s monetary policy committee. Committee members agreed that economic activity had decelerated more in recent months than they had anticipated at their last meeting in June. Some members even saw room for additional stimulus fairly soon if needed.

- “Nonetheless, the housing market continued to show improvement over the past few months. New home sales rose 3.6 percent in July matching May’s pace as the strongest month since April 2010. Similarly, pending existing home sales also rose in July to its highest rate since April 2010. And, the S&P/Case-Shiller® National Home Price Index rose 1.2 percent between the second quarter of 2011 and 2012, reflecting the first annual increase since the second quarter of 2010.”

Freddie Mac’s survey is the average of loans bought from lenders last week, including discount points.

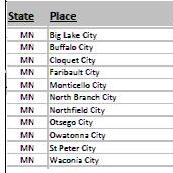

Follow this link to view today’s MN and WI best mortgage interest rates.

#