Your house is NOT worth what YOU think.

Minneapolis, MN: We’ve all had to listen to someone who, regardless of what the professionals tell them, simply believe their house is worth more than everyone else’s home.

Just because you reclaimed wood from the bottom of the Amazon River, put in a $50,000 landscape job, or installed super top end granite counter-tops, and just about any other high end item installed in your house; doesn’t mean potential buyers of your home are willing to shell out extra money for it.

Most potential buyers generally don’t care if you spent $30,000 in your kitchen, or $80,000 in the kitchen. Most buyers are only going to offer you what they feel the home is worth compared to similar homes down the street.

Keep in mind, that if you build a custom home, or add expensive upgrades to the home, do it because you love it, not because you expect to get the money back when you sell. The more unique the home, the smaller the pool of potential buyers.

Of course because I am a mortgage lender, I need to talk a little about refinance appraisals too. Essentially many of the same items apply to the value of your home during a refinance. The appraiser is going to look at same or similar homes in your area to determine your value too. The new roof and windows are maintenance that PREVENTS your home from losing value. Not improvements to increase value.

You are always better to be the lowest value home in a high value neighborhood than the other way around.

Your home is not worth what YOU think it is, it is worth what others think it is.

Minneapolis, MN: We’ve all had to listen to someone who, regardless of what the professionals tell them, simply belive their house is worth more than everyone else’s home.

Just because you reclaimed wood from the bottom of the Amazon River, put in a $50,000 landscape job, or installed super top end granite counter-tops, and just about any other high end item installed in your house; doesn’t mean potential buyers of your home are willing to shell out extra money for it.

Most potential buyers generally don’t care if you spent $30,000 in your kitchen, or $80,000 in the kitchen. Most buyers are only going to offer you what they feel the home is worth compared to similar homes down the street.

Keep in mind, that if you build a custom home, or add expensive upgrades to the home, do it because you love it, not because you expect to get the money back when you sell. The more unique the home, the smaller the pool of potential buyers.

Of course because I am a mortgage lender, I need to talk a little about refinance appraisals too. Essentially many of the same items apply to the value of your home during a refinance. The appraiser is going to look at same or similar homes in your area to determine your value too. The new roof and windows are maintenance that PREVENTS your home from losing value. Not improvements to increase value.

You are always better to be the lowest value home in a high value neighborhood than the other way around.

So what IS your home worth? It is only worth what others think it is, and what an appraiser says it is.

You can provide that in person, over the phone, or with a secure online mortgage application. Next will be a review of your basic documentation to verify and back up what you supplied on your application. If you said you make $60,000 a year, great, prove it with the last 30-days of pay stubs, the last two-years W2’s, and your federal Tax Returns. If you said you have $20,000 in the bank for down payment, great. Prove it by supplying your last two months bank statements.

You can provide that in person, over the phone, or with a secure online mortgage application. Next will be a review of your basic documentation to verify and back up what you supplied on your application. If you said you make $60,000 a year, great, prove it with the last 30-days of pay stubs, the last two-years W2’s, and your federal Tax Returns. If you said you have $20,000 in the bank for down payment, great. Prove it by supplying your last two months bank statements.

In terms of standard conventional 30-yr fixed mortgage rates, the BEST we’ve ever seen was for just a few days in 2012, when the best clients could get 3.125% – 3.25%.

In terms of standard conventional 30-yr fixed mortgage rates, the BEST we’ve ever seen was for just a few days in 2012, when the best clients could get 3.125% – 3.25%.

USDA announced last month that it was lowering its upfront mortgage insurance premium fee to 1 percent of the total mortgaged amount, down from the current from 2.75 percent. This amount is added to the borrowers loan. So someone today borrower needing a $100,000 loan would actually have a $102,750 loan. Under the new guidelines, the same borrower would have a $101,000 loan.

USDA announced last month that it was lowering its upfront mortgage insurance premium fee to 1 percent of the total mortgaged amount, down from the current from 2.75 percent. This amount is added to the borrowers loan. So someone today borrower needing a $100,000 loan would actually have a $102,750 loan. Under the new guidelines, the same borrower would have a $101,000 loan.

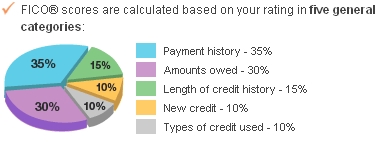

Be realistic. Have some down payment money and your overall finances in order before applying for a home loan. Know your credit score too, as you need a minimum credit score of 620.

Be realistic. Have some down payment money and your overall finances in order before applying for a home loan. Know your credit score too, as you need a minimum credit score of 620.