Minneapolis Down Payment Assistance

Own Your own Home!

The City of Minneapolis, in partnership with Minnesota Housing, the Minnesota Homeownership Center, and Mortgage lenders like us here at Cambria Mortgage are getting together to provide access to down payment assistance, quality, affordable mortgages and free, non-biased housing experts that can help you become a successful home owner!

Maybe you’ve thought homeownership wasn’t possible, or you didn’t know where to start. Maybe you thought your credit wasn’t good enough or you haven’t saved enough for a down payment. We can help!

Down Payment Assistance – Homeownership Opportunity Minneapolis

The City of Minneapolis wants to make affordable homeownership a reality for you. The City is providing up to $7,500 to qualified buyers to cover down payment and closing costs when purchasing a home anywhere within Minneapolis city limits. To qualify for this program, you must meet the following income eligibility requirements:

- Homebuyers with household income up to 115% of the area median income (currently $99,500) are eligible for up to $5,000

- Homebuyers with household income up to 80% of the area median income (currently $69,280) are eligible for up to $7,500.

Quality, Affordable Mortgages

Minnesota Housing, the State’s Housing Finance Agency, offers mortgage loans for first-time homebuyers with affordable interest rates. Our Minnesota Housing loans work seamlessly with down payment assistance products like those offered by the City of Minneapolis.

How To Get Started

Your first step is to apply for the mortgage loan itself. Your Cambria Mortgage Loan Officer will review the application, your credit, etc. They will discuss with you if you qualify, how much house you can afford, what the payments might look like, and what assistance you may qualify to receive. Click HERE to apply online (easiest) or call (651) 552-3681.

If that all looks good, you will need to submit standard loan documentation, which includes photo id, last two pay stubs, last two bank statements, and the last three years of W2’s and federal tax returns.

If that still looks good, you will be issued a Pre-Approval Letter, put in touch with a high quality Real estate Agent agent, and sent out to find your dream home.

In between the initial approval and closing on your new home, you will need to take the homebuyer education class listed next.

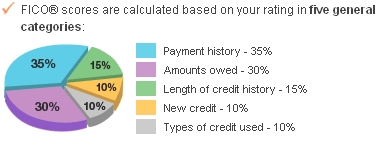

You do not have to have perfect credit, but you can NOT have BAD credit. All applicants must have a middle credit score of at least 640. Next, while you are receiving assistance, you can’t buy a home with no money. You must have at least $1,000 of your own money to put into buying the home.

Homebuyer Education

If you are a first time home buyer, this program from the City of Minneapolis, just like all first time home buyer programs requires all first time homebuyers to attend home buyer education.

There are two options: Attend a physical 8-hour class (Home Stretch) or take an online class (Framework Classes). Click the links below for more information of the required training.

Sign up for HOME STRETCH: In-person workshop Your first time homebuyer class can be taken in person in multiple locations throughout the state. The cost of this class is typically $25.

Sign up for FRAMEWORK: Online Education An online homebuyer education class can be started and stopped, and finished at your leisure. The cost of this training is $75. Most people take the online training.

When Your Class Is Completed: Print your Certificate of Completion and give a copy to your Loan Officer

More Information

Contact:

Joe Metzler, Senior Loan Officer. NMLS 274132

(651) 552-3681

What this means is that NO FHA lender can accept any purchase agreement dated less than 90-days from the last RECORDED title transfers,

What this means is that NO FHA lender can accept any purchase agreement dated less than 90-days from the last RECORDED title transfers,