Minneapolis / St Paul, MN: These days, everyone seems to know their “credit score”. Many people subscribe to one or all 3 credit services, or get a score from a place like CreditKarma.com.

Before you get too excited about that credit score, understand that the score numbers you just received most likely was based on the “Advantage Score” model. While that IS a credit score, that is NOT the same scoring model mortgage companies use.

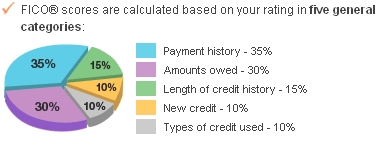

There are many different ‘types’ of credit scores.

Mortgage lenders care about how you handle mortgages, credit card companies care about how you handle credit cards. The reports these industries pull tend to be weighted towards their industry. The Advantage score you get when you look at your score, or from your credit card statement simply is NOT the same scoring model lenders use.

Another way to look at is is think about buying a car. You tell someone you bought a new Ford. Great, but what model Ford? Did you get a Ford Focus, or was in a new Ford Truck?

Getting your credit score somewhere?? Great, what scoring model is is based on? They are generally all FICO scores, but what scoring model is it based on?? Advantage score, Beacon Score? Typically the Advantage Score is noticeably higher than your mortgage score.

If the credit score you are looking at is from a mortgage company, then that should be accurate if any other mortgage company pulls your credit… Or at least until something changes, and credit scores can potentially change everyday. I’ll save that for another article…

Ultimately, the ONLY credit score that matters is the credit score your Loan Officer obtains on the day you start your mortgage application!

For most people, the score you see and get on your own, or through your credit card statement are close, and give you a ballpark idea of your lender score, but don’t be surprised when we tell you a different number.

The biggest hurdle for many first time home buyers is the lack of down payment money. With the down payment assistance programs from the Minnesota Housing Finance Agency – you can buy a new home today, and be enjoying it next month!

The biggest hurdle for many first time home buyers is the lack of down payment money. With the down payment assistance programs from the Minnesota Housing Finance Agency – you can buy a new home today, and be enjoying it next month!

Mortgage interest rates are likely to move up and down many times during this lockable period, which is usually 60-days or less. Rarely do we see rates make big moves, rather just small moves of 1/8th to 1/4 percent higher or lower during that period. A typical example week may be something like 4.625% on Monday, 4.75% on Tuesday, 4.625% on Wednesday, 4.50% of Thursday, and 4.625% again on Friday.

Mortgage interest rates are likely to move up and down many times during this lockable period, which is usually 60-days or less. Rarely do we see rates make big moves, rather just small moves of 1/8th to 1/4 percent higher or lower during that period. A typical example week may be something like 4.625% on Monday, 4.75% on Tuesday, 4.625% on Wednesday, 4.50% of Thursday, and 4.625% again on Friday.

Less homes for sale than what we’d like to see, combined with fewer foreclosures, and low mortgage rates continue to fuel these price increases. New listings were up in June by over 20% from last year, but still there are more buyers than sellers, sparking competition amongst buyers.

Less homes for sale than what we’d like to see, combined with fewer foreclosures, and low mortgage rates continue to fuel these price increases. New listings were up in June by over 20% from last year, but still there are more buyers than sellers, sparking competition amongst buyers.