You are fully pre-approved with your mortgage lender, and out looking at new homes.

How many homes should we look at before buying?

Real Estate Agents and lenders get this question all the time. The answer? It depends.

Real Estate Agents and lenders get this question all the time. The answer? It depends.

Realistically, most people only physically need to look at between 5 – 7 homes before deciding on which one to make an offer on. Some look at 1 or 2 homes before making and offer, and some look at 20 plus homes. The trick is to work with your Real Estate Agent and Loan Officer to have realistic expectations of your wants, needs, goals, and affordability.

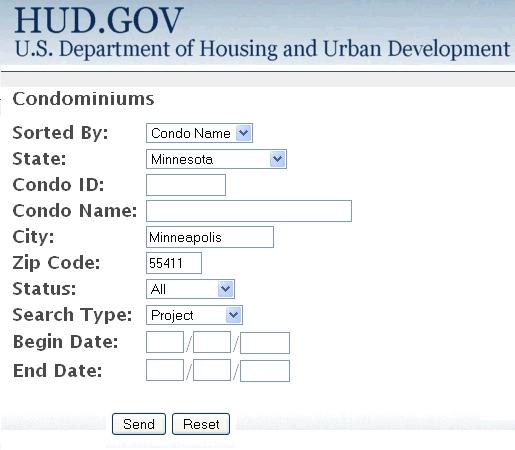

The first step is to get pre-approved with a local Minneapolis area mortgage broker.

This way you’ve already discussed mortgage loan programs, down payment and loan requirements, and have set a realistic home purchase price. How can you even start looking at homes if you don’t know this information?

Meet with the Real Estate Agent

With mortgage knowledge in hand, now you can meet with a local Realtor to go over your housing needs, Bedrooms, neighborhoods, yards, features, priorities, and more. Your agent will discuss all of these items, and figure out a realistic plan. Usually they will then set up some automated listings to be sent to you by Email that meets your criteria. When you find some that you like, now it is time to physically go look at homes.

Because you’ve already discuss financing, and set good expectations with your Realtor, you can usually achieve the dream of home ownership without looking at dozens of homes. It’s all about educating them up front and getting on the same page.

First Time Home Buyers

Many first time home buyers in the Minneapolis, MN area look at a little high average, more like 7 – 10 homes before buying. This is OK, as they sometimes need to discover features and options on homes that they may have not been as familiar with as a move up buying looking at their second or third home.

The Bottom Line is that there is no set number

Each person is different. But if you’ve physically looked at more than 10 homes, it is probably time to sit down with your mortgage and real estate professional to re-examine your housing wants, needs, goals, and affordability.before they find the right home.

Less homes for sale than what we’d like to see, combined with fewer foreclosures, and low mortgage rates continue to fuel these price increases. New listings were up in June by over 20% from last year, but still there are more buyers than sellers, sparking competition amongst buyers.

Less homes for sale than what we’d like to see, combined with fewer foreclosures, and low mortgage rates continue to fuel these price increases. New listings were up in June by over 20% from last year, but still there are more buyers than sellers, sparking competition amongst buyers.

Another problem is many web sites don’t update daily, or even weekly. Newspapers, and other print media may have collected rate information on Wednesday morning for publication in Sundays paper. This week, that would leave people with quotes at least .375% to .500% lower than reality.

Another problem is many web sites don’t update daily, or even weekly. Newspapers, and other print media may have collected rate information on Wednesday morning for publication in Sundays paper. This week, that would leave people with quotes at least .375% to .500% lower than reality.