Barclay Banks LIBOR Scandal Explained, and what it means to YOU.

Log in and post your comments!

Log in and post your comments!

In Real Estate – When You Snooze, You Lose!

Minneapolis / St Paul, MN: A big shift in the housing market in our area has taken many by surprise. Any qualify house under $200,000 is selling in just days, with multiple offers, and above asking price.

With dwindling inventory, mostly from fewer foreclosures, increased demand with more competition because of terrific interest rates, we are seeing more and more multiple offers. This often happening soon after a property hits the market. It brings to mind the popular axiom “when you snooze you lose.” Wait too long to look at a great, well-priced property, or to make a strong offer, and you’ve lost your opportunity.

The problem some of you must confront is that even once you learn NOT to snooze and to move fast, you still might lose.

Why??

Is this the case with all properties? Certainly not. But we are seeing more competing offers at many price points, and new listings moving more quickly than in the past few years. This is not intended to scare you, and or make you feel that you cannot compete effectively. Simply understand the market has shifted in some significant ways and you need to be aware so you can react accordingly when you find a home you really like.

PAUSE – if you aren’t ready to jump, then you shouldn’t. Just because things have heated up and there are “bidding wars” does not mean you should get bent out of shape or move quickly on an offer when you are really not ready. It’s a huge decision and an expensive one that shouldn’t be taken lightly. Make the decision that is right for you. And be prepared to live by it.

Tips to help you win the deal:

Government Fraudsters Got Special Mortgage Loans – AND THEY ARE STILL IN CHARGE!

What do you think about this crap? Log in and post

It happens every day. First-time home buyers, partly due to enthusiasm or partly due to ignorance, make costly mistakes during the home buying process. Like buying more house than you can reasonably afford, or simply buying the wrong house because they thought they were getting a deal.

To help you keep your sanity and your cash, become an educated consumer and avoid the mistakes others have made before you. Here are a few common mistakes new home buyers should avoid:

Big Mistake #1

Not planning ahead. From the moment you think about buying a home, start planning. Start by requesting a copy of your credit report. Carefully examine it for errors and be prepared to answer questions about items on your credit report. Talk to your MN based mortgage lender before you attempt to rectify errors on your report – in some cases your attempts to rectify credit report errors can cause a delay in the approval of your loan. Talking with a licensed Mortgage loan professional (not an unlicensed bank application clerk) can provide you valuable guidance when it comes to improving your credit score or correcting errors.

Are you currently renting? Check your lease for an early release clause. If you’ll be subject to penalties, try to time your closing with the expiration of the lease.

During this planning phase, consider your life over the next five to seven years. Do you plan to start a family? Will an in-law eventually move in with you? Will you be working from home? The number and layout of the rooms you require will depend on your answers. If you qualify for financing based on a dual income, will you be able to survive on one salary in order to fulfill a long-range plan, such as one parent staying home to raise a child? Once you’ve answered these questions, establish a plan. Then direct the process with reference to the plan. Don’t let the process dictate to you.

Big Mistake #2

Failing to understand the home buying process. First-time home buyers need to ask questions, lots of questions. Choose a real estate agent and licensed mortgage professional who each have experience working with new home buyers. Experienced Realtors and financing professionals should be willing to explain the entire home buying process – from viewing homes, to negotiating, to financing, to escrow and closing in detail, and explain it again until you understand it. Do NOT tolerate a Realtor or Loan Officer you are not comfortable with or someone who treats you like a number.

Big Mistake # 3

Getting in too deep. It can happen when home buyers shop outside their budgets or over-extend themselves. What can you do to avoid getting hooked? Monitor your expenses for a couple of months. Then, based on your findings, develop a budget that truly reflects your lifestyle. Talk to a real estate agent who can provide insight into new home expenses and taxes. Then revise your budget.

Don’t buy a home thinking you’re getting a deal because the previous tax value was high, and the current price is low. If it was worth the previous tax value, that is what it would be seller for!

I always do this in the hopes that all the steps taken on my part will motivate my clients to do their part. That they’ll organize, gather the documents needed, and be fully-prepared for our appointment together. It makes for a far more smooth and quick application appointment and gets us both off to a good start.

Assurances had been received from this couple that “they had it under control”. They’d have all the required documentation in hand for our meeting.

And you know where this is going …

Instead the entire appointment was bogged-down while this couple rummaged through old paperwork and bills, searching for the documents they needed. And of course, they never found.

During the time they were rummaging, both were very distracted, unable to pay attention to what I was saying. I’m betting, they didn’t retain half of what was said.

As they became more and more rattled, they sniped at one another … and then their comments to me started to take on an “edge” too. As their situation became more overwhelming to them and their frustrations grew, it was clear the appointment needed to end. Directions were given to E-Mail and fax the remaining info I needed and then the application was over.

Why do I relate this story?

Because so much of the success to be found within mortgage financing, rests upon how well borrowers are prepared for the process. That preparation takes time, no doubt. Takes effort. Takes organization on the applicant’s part. It demands their attention.

Today’s mortgage application and underwriting process is challenging. But much of the challenge can be overcome by home buyers if they follow the advice I give them. Both verbally and above.

Taking the time to prepare, get organized, pay attention, make the effort … it all pays off in big ways. Not least of all in how pleasurable the process of financing ends-up being.

Not do or see to these things? You WILL encounter problems and big frustrations for sure. You will rob yourself of the enjoyment of buying your home. And certainly, that’s not what you want.

Avoid that outcome. Right from your first inquiry, call, or contact with your mortgage lender and agent. Be thoroughly involved. Be prepared. Be organized … or get yourself organized. Follow-up on all requests made of you in a timely fashion.

Do these things and you will feel and be much more in control of the direction your mortgage processing takes, as well as its outcome. You’ll also greatly improve your chances for a more enjoyable mortgage process and home buying experience along the entire way.

Of course, working with a mortgage professional with over 20 years of experience and expertise helps a lot too!

A Trick to Pay Off Your Mortgage In Half The Time

Minneapolis, Minnesota: Sounds like a claim you might see on a SPAM E-Mail you receive. The fact is, smart people are doing this everyday to pay off their mortgage in half the time and there is nothing special about it.

What is it you ask? Easy, simply shorten your term to a 10-year or 15-year mortgage loan.

Many homeowners are thinking of refinancing to today’s historically low mortgage rates here in MN, WI, and the rest of the country. Great, yet many people make the mistake of refinancing back into another 30-year loan. Sure, you may save a few hundred dollars, but how much is it going to cost by adding back all those years? How about retirement? Wouldn’t it be nice to go into retirement WITHOUT a mortgage payment?

Many homeowners are thinking of refinancing to today’s historically low mortgage rates here in MN, WI, and the rest of the country. Great, yet many people make the mistake of refinancing back into another 30-year loan. Sure, you may save a few hundred dollars, but how much is it going to cost by adding back all those years? How about retirement? Wouldn’t it be nice to go into retirement WITHOUT a mortgage payment?

By lowering your term, you get a better interest rate than on a 30-year, and you save untold thousands of dollars in interest.

Fear of higher payments on the shorter term loans keeps many people from selecting this mortgage savings option. But a quick peak at a mortgage calculator can show you the savings – and I’ll bet most people can easily afford the payment if they simply put their mind to it.

FHA Refinance

Homeowners enjoy the benefits of investing in their property year after year. For some, there comes a time when that investment can come in handy. Refinancing with an FHA loan can prove to be an effective way to put that equity to work. Keep in mind that FHA refinancing is only available to homeowners who are currently using their home as their principal residence.

FHA options to homeowners who are considering an FHA refinance mortgage:

This refinancing option is especially beneficial to homeowners whose property has increased in market value since the home was purchased. A Cash Out refinance allows homeowners to refinance their existing mortgage by taking out another mortgage for more than they currently owe.

This refinancing option is considered streamlined because it allows you to reduce the interest rate on your current home loan quickly and oftentimes without an appraisal. FHA Streamlined Refinance also cuts down on the amount of paperwork that must be completed by your lender saving you valuable time and money.

FHA Up Front Mortgage Insurance Premiums (UFMIP)

FHA has recently made changes to the required mortgage insurance. June 11, 2012 is the date FHA Up Front Mortgage Insurance Premiums (UFMIP) will be lowered for some borrowers applying for FHA Streamline Refinance Loans. An FHA Mortgagee Letter 12-4 explains the changes, which affect some, but not al, FHA streamline refinancing loans:

For all FHA Streamline Refinance transactions that are refinancing existing FHA loans that were endorsed on or before May 31, 2009, the UFMIP will decrease from 1.75 percent to just 0.01 percent of the base loan amount.

Basically, those borrowers who have an FHA home loan for a single-family property that was endorsed on or before May 31, 2009 are eligible for a lower rate on their Up Front Mortgage Insurance Premiums. It’s important to note that this rule applies only to those with an FHA Streamline refinancing loan with a case number assigned on or after June 11, 2012.

The same mortgagee letter contains another announcement; “Decrease to Annual Mortgage Insurance Premium on Certain Streamline Refinance Transactions”. In this message, the FHA states, “For all Single Family Forward Streamline Refinance transactions that are refinancing FHA loans endorsed on or before May 31, 2009, the Annual MIP will be 55 basis points, regardless of the base loan amount.”

These two items make for a very significant savings on FHA streamline refinance transaction here in Minnesota, Wisconsin, and the rest of the country.

One other item. It’s important to remember that the FHA does not regulate FHA streamline mortgage interest rates or set them in any way except to state that such rates must be reasonable and customary according to the housing market in that area. Borrowers should expect to negotiate interest rates with the lender and/or comparison shop for the best rates and terms.

SHORT SALES: TOP 10 MYTHS DEBUNKED!

Myth #1: The homeowner must fall behind on mortgage payments in order to qualify for a short sale. Truth: Years ago this may have been true, but not today

No one should be advised to miss a mortgage payment.

Myth #2: Banks would rather foreclose on a property than approve a short sale. Truth: Many still believe this myth to be true, but more accurately, banks would prefer not to foreclose on a property due to the $50-70k it may cost the bank per transaction. Banks lose less money on a short sale than on a foreclosure.

Myth #3: Homeowners must be pre-approved by their lender to be eligible for a short sale. Truth: Absolutely not true. By and large, most lenders will consider short sale offers. However, each lender may have unique and specific processes to follow, from listing the home to the acceptance of a short sale. Bypassing any part of this process may result the sale not closing, so be sure to follow each lenders’ processes closely.

Myth #4: Short sales never close. Truth: Obviously not true. In some areas of the U.S., nearly 50% of all closings are considered to be “distressed” properties, meaning REOs and short sales.

Myth #5: Short sales take months (and months) to close. Truth: The short sale processes must be learned. Once mastered, it may not be uncommon to close a short sale in 30 days. However, certain idiosyncrasies may slow the process and each lender presents their own unique set of specific challenges. No two short sale transactions are identical.

Myth #6: Damage to the homeowner’s credit standing is comparable in a short sale and a foreclosure. Truth: In many cases, credit repercussions and deficiency protections are more damaging with a foreclosure. Short sale transactions can often lead to faster financial recovery for the homeowner and should be carefully considered. Note: If the homeowner missed no mortgage payments, they may be eligible to finance the purchase of a home immediately following a short sale transaction.

Myth #7: Following a short sale, the homeowner will be ineligible to purchase another property for the next 7 years.

Truth: Not true. Using conventional lending guidelines, some consumers may obtain a Fannie Mae backed mortgage a short 24 months after the close of their short sale with 10% down payment. FHA loans is three years.

Myth #8: After a short sale transaction, the homeowner will receive a 1099 and be forced to declare the loss as income.

Truth: The owner may indeed receive a 1099, but due to the 2007 Mortgage Forgiveness Debt Relief Act, among other considerations, the homeowner may not owe any taxes on their transaction. Note: This Act is due to expire at the end of 2012.

Myth #9: The lender will sue the homeowner after the close of a short sale (or foreclosure, or deed in lieu of foreclosure) for the deficiency.

Truth: Each state and each transaction is different. Many states have anti-deficiency protections in place for short sales and foreclosures.

Myth #10: Real Estate Agents don’t need additional training to learn all of the ins and outs of the short sale process.

Truth: Only work with agents experienced in short-sales.

An FHA STREAMLINE REFINANCE is HOT right now because of the super low mortgage rates, so it is important to understand a possible FHA Mortgage insurance refund you may qualify for.

If you have an FHA loan, FHA charges an upfront MIP (mortgage insurance premium). This amount is calculated as a percentage of the loan amount, then added to your loan amount. That MIP amount you paid depends on when the FHA case number was requested.

If you’ve had your FHA loan for less than three years, and your are refinancing to a new FHA loan, you get a refund of some of the initial mortgage insurance premium (MIP) you paid on your FHA loan

The chart below is what FHA underwriters use to determine the amount of money refunded at the time of a FHA to FHA refinance. FHA will refund a percentage of that upfront MIP in the refinance. No refund check or anything is given to you, the refund is simply calculated into the costs of the new loan. The shorter the home owner has had the current FHA loan the higher the refund amount. This amount is displayed on page four of the application section called the “details of transaction” page.

FHA MORTGAGE INSURANCE REFUND CHART

Example: You are refinancing, and at the time of closing, your current loan would be 2-years and 2 months old. Looking at the chart, you would get a 54% of the original MIP refunded to you as a credit on your new loans closing costs.

7 out of the 11 Twin City County Areas are eligible. These properties are closer than you think!

The USDA Guaranteed Rural Housing Mortgage Program offers individuals and families 100% financing for semi-rural to rural properties throughout the state of Minnesota and Wisconsin.

Consumer Financial Protection Agency not protecting anyone – More harm to consumers with more asinie rules.

Credit is very important throughout your life, and of course knowledge is power. Download this free booklet.

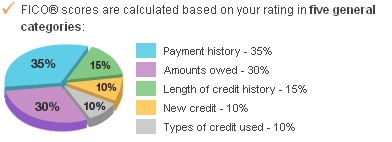

Knowing and Understanding your FICO Score

Mortgage Rates are at Historic Lows. Start saving money now on your VA Home Loan!

Mortgage Rates are at Historic Lows. Start saving money now on your VA Home Loan!Minneapolis, MN: If you are a veteran, you are eligible for a great benefit, the VA Home Loan. If you currently have a VA Home Loan, you may qualify for another great benefit, the VA Streamline Refinance Loan.

Officially known as The Interest Rate Reduction Refinance Loan (IRRRL), it is one of the easiest refinance loans available today. The VA Streamline Refinance is the second best programs offered to you through your housing benefits from the Veterans Affairs (the first was buying the home with a VA Home Loan!)

Potential NO Appraisal (upside down might be OK)

Lower Credit Scores

NO Qualifying Debt Ratios

NO Income Verification

NO Out of Pocket Expenses

A good local VA Mortgage Leader will show you how to utilize your Certificate of Eligibility and lower your rate and start saving money today.

What you MAY NOT know about insurance

There are many considerations in selecting home insurance. One you may or may not know of is “Family liability protection coverage”. This protects you for medical expense in the event that someone is seriously injured on your property.

Many people choose $100,000 in protection, but an accident resulting in someone who has to be in intensive care for a week, or who has an extended hospital stay on top of intensive care may eat up that $100,000 in protection rather quickly. Once the $100,000 is exhausted, a client is personally on the hook for anything above that, and the home typically ends up with a lien.

An increase in protection to $300,000 can cost as little as an additional $35 per year. It’s the kind of options that a good insurance agent points out to clients to ensure the client’s assets are protected, and something the online quoting systems just can’t show you!

Also, you may want to cover yourself with at least a Million Dollar umbrella policy. Sounds exotic and expensive, but is actually awesome and inexpensive.

MCLEAN, Va., May 31, 2012 /PRNewswire/ — Freddie Mac (OTC: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates following bond yields lower to new all-time record lows. The 30-year fixed averaged 3.75 percent setting a new all-time record low for the fifth consecutive week. The 15-year fixed averaged an unprecedented 2.97 percent bringing three of the four benchmark mortgage rates below 3 percent for the first time in Freddie Mac’s weekly survey.

NOTE: Rates reported by Freddie Mac are averages from last week, and may or may not be reflective of actual interest rates available today, nor your individual situation

News Facts

Minneapolis, MN: Metro area home prices were up 3.3% in March according to the widely watched Case-Shiller home price index.

Minneapolis, MN: Metro area home prices were up 3.3% in March according to the widely watched Case-Shiller home price index.

This report confirms what what I have been saying for some time now – that home prices in the Minneapolis / St Paul area are increasing, the market is stabilizing, and that especially in the sub $200,000 price range, good houses are going fast with multiple offers above asking price just days on the market.

All real estate is local. Our increase bucks the nationwide trend. Overall, U.S. home prices fell in March, ending the first quarter with some of the lowest levels scene since the housing crisis began in mid-2006. During the first quarter, home prices nationally reached new lows, falling 1.9 percent year-to-year.

Nationwide, average home prices are down roughly 35 percent from their peak in the second quarter of 2006.

Demand for homes has been showing some serious signs of stabilization, as low mortgage rates, low home prices, and improved job growth have pushed first time home buyers off the fence and into the housing market.

According to information from the Minneapolis Area Association of Realtors, March marked the first time since 2010 that median home prices had risen in the Twin Cities. The Minneapolis / St Paul median home price rose 6.4 %, to $149,000. The positive news continued in April, when a shrinking supply of homes on the market helped drive the median sales price up 12.4% to $163,000. Foreclosures and short sales also made up a smaller share of sales in recent months, which helped boost prices.

Forget the national reports. In this market, everyday you wait is going to cost you. Get pre-approved today, and be in your own home next month.