What does your credit score say about you?

Everyday I am looking at credit reports, and making credit decisions. It amazes me sometimes the people who call and say they have good credit, when they don’t. It also amazes me the people who have good credit, and fear they can’t get a loan.

So What’s Your FICO Credit Score?

So What’s Your FICO Credit Score?

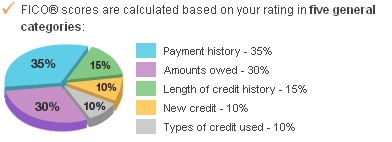

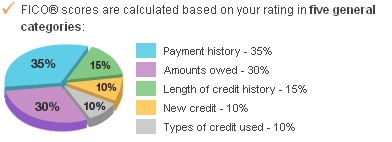

Every lending facility uses basic guidelines to determine your credit worthiness, including your FICO credit score. Upon reviewing your mortgage application, you’re given a credit grade and credit scoreand a determination regarding your home mortgage loan approval or denial.

There are no hard-and-fast rules for determining your specific credit score grade. Each lender’s criteria may vary slightly, but generally speaking, if you have a mix of credit type (mortgage, revolving, car loans), you have had it for awhile, and you make your payments on time. You have nothing to worry about.

800 + Credit Score: AAA+ A credit score of 800 plus is basically flawless credit. This is usually obtained only with a long history of unblemished credit. You will get the best of the best anything credit related, from mortgage loans to car insurance. Scores in this bracket represent about 13% of the population.

740-799 Credit Score: AA+ A credit score of 740-799 is considered great credit, and will typically result in the best interest rates and approval rates for anything credit related. You have nothing to worry about if you scores fall in this category. In fact, roughly 27% of the population has a credit score of 750-799 alone.

700-739 Credit Score: A+ A score in this bracket is considered good credit. Although it’s not perfect, you should still be able to qualify for most home mortgage loans and auto or rental leases. You may be offered a slightly higher interest rate than offered to borrowers with excellent credit for mortgage loans, credit cards, car insurance, and homeowners insurance.

680-699 Credit Score: B+ Credit scores from 680 – 699 are considered average. You should never have any problems getting basic financing, but you are now in the area where you may pay a slightly higher rate, be required to have a bigger down payment, or be offered less favorable terms. There will be situations where a credit score in this range may prevent you from getting certain types of financing, such as an zero down mortgage loan, the lowest auto insurance premium, or a zero down car loan.

620-679 Credit Score: C Credit scores from 620-679 are still considered “good” or “ok” by many creditors, though you may see further restrictions and fewer approvals when attempting to get a car loans, credit cards, or a mortgage. For example, you can still get an FHA mortgage with this score, but a lot of conventional loan lenders would deny you with a score below 660. Large numbers of people have score in this range. It would be very wise to evaluate why your score is in this range and try to improve it. In this range, you are NOT getting the best deals in the market.

580-619 Credit Score: D Credit scores in this range are bad, and clearly below average. If you are on the lower end of this range and someone asks, you can answer “I have bad credit“. You will have a difficult time securing a loan, or applying for a credit card. If you are able to secure financing, you’ll find higher interest rates for your low credit scores. If your credit score falls in this range, you definitely need to take a hard look at your credit report and take measures to raise your credit score. Many consumers with credit scores in this bracket are considered “subprime” and may have to work with bad credit banks and lenders to secure financing. You’re basically throwing money away at this point because of your poor credit.

500-579 Credit Score: F

No discussions, no glossing over it. Credit scores in this range are just flat out bad. If you’ve got a credit score in this range, there’s a good chance you have a major derogatory items on your credit report such as as major late payments, court judgements, collections, foreclosure, or a bankruptcy. There is no question that your credit score is in need of serious credit repair. You will almost always be denied for credit with this score range, or pay such a premium for the credit, it usually is not worth it. You’re clearly paying higher interest rates and making credit mistakes that will impact your life for years to come.

Below 500 Credit Score

Credit scores below 500 are very bad. You almost have to get up everyday and ask yourself “how can I further wreck my credit today” to be in this category. You will usually have current, or very recent major issues, such as a bankruptcy or foreclosure. Improving credit from this level will usually take years to repair (but it can be done). Credit will universally be denied, and you will be paying a major premium on things like car insurance.