The FHA Streamline Refinance program.

No appraisal, no closing costs, easy qualifying, and even skip a month of payments.

General Topics

No appraisal, no closing costs, easy qualifying, and even skip a month of payments.

Minneapolis, MN: Life happens. For all sorts of reasons, from divorce, job loss, or a major medical event, people can sometimes get into financial trouble. The worst thing anyone can do is bury your head in the sand. It isn’t going away, and is usually easier to deal with early on. Ask friends and relatives for help right away.

Other Alternatives to Foreclosure

Other Alternatives to Foreclosure

Reinstatement

A reinstatement is the simplest solution for a foreclosure, but often the most difficult to achieve. The homeowner simply comes up with the money to pay the total amount past due (including late fees) to the lender. This is a great option early on.

Bankruptcy

Many believe bankruptcy is a “foreclosure solution,” but this is only true in some states and situations. Entering bankruptcy can be a risky and costly process. Be sure to seek the advice of a qualified bankruptcy attorney when pursuing this as an option.

Refinance

Refinancing means you will acquire a new loan based on your current credit standing. If you have already missed mortgage payments, those missed payments and now damaged credit scores may make it difficult to get approved for a new mortgage loan

Mortgage Modification

A mortgage modification involves the reduction of one of the following: the interest rate on the loan, the principal balance of the loan, the term of the loan, or any combination of these. Contact your current lender to discuss a modification.

Deed-in-Lieu

Also known as a “friendly foreclosure,” a deed-in-lieu allows the homeowner to return the property to the lender rather than go through the foreclosure process. Contact your lender on how to “give back the keys.”

Forbearance

A forbearance or repayment plan involves the homeowner negotiating with the mortgage company to allow them to repay back-payments over a period of time. Typically this involves putting the past due payments to “the back of the loan.”

Short-Sale

A short-sale is exactly what the name implies. You put the home up for sale, and find a buyer. Unfortunately, the sales prices is less than you owe. You will then negotiate with the bank to accept the sales prices as payment in full. While still damaging to your credit, it is better because you usually are able to walk away free… with the bank never coming after you for any money they lost. On a true foreclosure, they can usually come after you later on for any loss.

Rent the Property

This option does not require lender approval, but does require the homeowner’s ability to rent the house for enough money to cover the monthly mortgage payment. Being a landlord isn’t overly difficult, but isn’t for everyone.

Service members Civil Relief Act

If a member of the military experiences financial distress due to deployment-and their debt was entered into prior to deployment-he or she may qualify for relief under the Service members Civil Relief Act.

Minneapolis, MN: VA Home Loans In MN and WI are probably the coolest mortgage loan lenders offer.  It is available both while serving our country and after they are discharged.

It is available both while serving our country and after they are discharged.

Upon a veterans return, hey usually are looking to re-establish themselves the the communities that they will be returning to. This means that many of them will be looking to purchase a home that they can settle in and raise their families. A VA Mortgage can assist our Veterans in making that transition.

VA Mortgages provide our Veterans with two major advantages that other Mortgage programs do not have.

VA Loans require no down payment, and have no mortgage insurance, plus you can roll all your closing costs into the loan. This makes for one heck of a great first-time home buyer deal for military veterans wanting to buy a home! The country appreciates your service. This is one way we pay you back. Today mortgage rates on VA loans are very low, making homes even more affordable.

VA Mortgage benefits for a Veteran:

A VA Streamline Refinance is similar to the FHA Streamline Refinance. It is officially known as a IRRRL loan (interest rate reduction refinance loan) because of the money you can save by lowering your monthly interest rates. It was created by the VA in an effort help our veterans secure the lowest interest rate possible. This VA loan process is done quickly, with minimal hassle so our veterans can save immediately.

Those who are eligible:

Minneapolis, MN: Freddie Mac yesterday released the results of its most current Primary Mortgage Market Survey(R) (PMMS®), showing average fixed mortgage rates unchanged from the previous week and remaining near their record lows as they continue to support housing demand, translating into a pick-up in home prices in most markets.

Freddie Mac’s survey is the average of loans bought from lenders * last week, including discount points. Applicants must pay all closing costs at these rates. No cost loan rates higher.

Follow this link to view today’s best MN and WI mortgage interest rates.

Quotes

Attributed to Frank Nothaft, vice president and chief economist, Freddie Mac.

“Mortgage rates remain near record lows and continue to support housing demand, translating into a pick-up in home prices in most markets. The median sales price of existing homes rose 10 percent between fourth quarter 2011 and 2012, the largest year-over-year gain in seven years. Among large metropolitan areas, 88 percent saw positive annual increases in the fourth quarter, compared to 81 percent in the third quarter and 75 percent in the second. The largest gains occurred in Phoenix (34 percent), Detroit (31 percent) and San Francisco (28 percent).”

Minneapolis, MN: The popular FHA loans, requiring just 3.5% down payment are about to become more expensive.

Minneapolis, MN: The popular FHA loans, requiring just 3.5% down payment are about to become more expensive.

Starting on April 1, 2013, the mortgage insurance premium will go up by .1% to 1.35%. While this is small, this is the most expensive mortgage insurance of all loans available in the market! This is also on top of the more than doubling of FHA mortgage insurance two-years ago. These staggering increases in mortgage insurance is highly expected to continue the decreased use of FHA loans.

To add insult to injury, on June 3, 2013, FHA mortgage insurance, which currently goes away when your loan-to-value drops to 78%, will be changed to “life of loan”. Another words, it will NEVER go away, regardless of down payment or loan-to-value. This will only be one NEW loans. Existing FHA loans will not change.

Example: Purchase Price $175,000 3.5% down payment at 4% mortgage rate on 30yr. Currently, that mortgage insurance would end at 78%, and cost someone $20,838. Under the new rule, the mortgage insurance would be on the loan forever, and cost someone $42,447 – MORE THAN DOUBLE the cost.

There are buyers that qualify on income and credit who may not have the necessary additional down payment required for the 5%, or 10% down conventional loans. The 3.5% FHA program has provided a great vehicle to get into a home with a minimum amount of cash.

The average time for FHA mortgage insurance to go away is about 9.5 years. So for homeowners who anticipate staying in their home for ten years or less, the new changes might not have much financial impact. However, homeowners who expect to be in their home longer should seriously consider going with a 5% down conventional loan if at all possible.

For buyers currently in the market, you can avoid these increases by acting now.

Minneapolis, MN: As anticipated, Democratic Sens. Robert Menendez, NJ, and Barbara Boxer, CA, this week reintroduced a bill that could spur more refinances.

The Responsible Homeowner Refinancing Act, (AKA HARP 3) among other things, has a stated goal of relaxing requirements for borrowers to refinance and would extend the Home Affordable Refinance Program (HARP) for an extra year through 2014. It is currently set to expire December 31, 2013.

The Responsible Homeowner Refinancing Act, (AKA HARP 3) among other things, has a stated goal of relaxing requirements for borrowers to refinance and would extend the Home Affordable Refinance Program (HARP) for an extra year through 2014. It is currently set to expire December 31, 2013.

Currently, the HARP Refinance program only allows people who have a loan owned by Fannie Mae or Freddie Mac to refinance an underwater home. HARP 3 would allow ALL underwater homes to be refinanced.

Stay tuned for more details.

St Paul, MN: I just ran across this issue, and thought it was interesting to pass along.

Suppose a thief breaks a window in Joe McHomeowners home and crawls through. Joe McHomeowner, the insured, uses a baseball bat to knock out the intruder and then calls the police.

Suppose a thief breaks a window in Joe McHomeowners home and crawls through. Joe McHomeowner, the insured, uses a baseball bat to knock out the intruder and then calls the police.

In today’s world, it is likely the thief will sue for his injuries. Is Mr McHomeowners liability for the thief’s head injuries covered by his homeowners policy?

The answer is YES. Joe McHomeowner’s liability is covered because he used reasonable force to protect persons and property.

When buying a home, be sure you get proper homeowners insurance. A great policy is usually only a few dollars more per month over cheap insurance. Be sure to talk with a licensed insurance agent – not just a web site – to make sure you are fully and properly covered on your home.

St Paul, MN: What do you get with a online insurance provider like Progressive, Esurance, or Geico?

Well they tell you they have a great price, but come on, what insurance ad have you ever seen that doesn’t promise that. We think the much more important issues are knowledge and coverage. Do you really think their national call centers, filled with order takers trying to help you complete your online quote, really know anything about it?

A great example is the number of people in MN who carry the minimum state required auto insurance coverages of 30/60/10. It is the cheapest coverage, but leaves you grossly under-protected. If you talked with a real live insurance agent, they could explain that poor coverage… But more importantly, explain how for usually around just $100 more a year, you could move up to awesome insurance coverage.

As you evaluate coverage and providers, ask about why you need higher limits as a homeowner, or when you have young drivers, or higher liability limits when you have a dog, trampoline, or pool?

These are all great reasons why you want to talk to an agent that lives, works, and understands the local Minnesota insurance market and can advise and help you make the right decisions.

These are important decisions. There isn’t much point in saving $20 a month if you end up owing for a loss of $40k or $50k that should have been covered but isn’t! Talk about MAYHEM.

On top of that, talking with a live insurance agents usually save people money over these online order centers to boot. Don’t let your friends and family get duped by all the hype and commercials.

Have them call a local insurance provider like The Reliable Insurance Network for a quote and get real service along with a great price.

Minneapolis, MN: Thinking of refinancing your home? Are you a First Time Home Buyer? Homeowners have thousands of choices when it comes to shopping for their mortgage loan, and sometimes all these options can spell trouble.

Pretty much every phone call I take starts with “What’s your interest rate?” While this seems like a very logical question to ask, it doesn’t give the lender all the information needed to give you an accurate answer.

This goes for online mortgage interest rate search tools too. While you may put in some basic information, I haven’t seen a system yet (including ours) that could ever replace a actual Loan Officer and be 100% accurate.

This goes for online mortgage interest rate search tools too. While you may put in some basic information, I haven’t seen a system yet (including ours) that could ever replace a actual Loan Officer and be 100% accurate.

There is no generic rate: A common misconception is there is a “rate”… We’ve all hear the commercials… “The rate today on a 30-yr fixed is ____, and only at so and so company.” I cry foul! The only way you can ever get an accurate interest rate quote is to supply a mortgage company with a complete application, and the lender also reviews a credit report.

Credit Score: To accurately quote you an interest rate, a lender has to run your credit to determine your credit score. Interest rates can vary greatly on some programs depending on credit score. Most loan programs have pricing adjustments based on credit score, so without looking at your credit, any lender quote is just guessing. While I like to believe what people tell me, until I see for sure, it doesn’t mean anything. I can not tell you how many times someone has said “I have excellent credit,” (which is a 740 middle credit score or higher), so I quote them based on that score, only to actually review their credit the next day to find out their score is a 700. On some programs, the difference between a 740+ score, and a 700 score could mean as much as 1/4% (.25) higher interest rates!

There are at least 21 criteria that goes into determining your interest rate. Here is a small sampling:

I consistently hear, after I’ve taken a full application and accurately quote a client “That’s different than I saw (online, in the news paper, on TV).” The general attitude is that my quote is high. The reality is you are usually comparing an accurate quote against teaser advertising rates, or rates that do not apply in your situation.

So be mindful of the difference between advertising and reality. Let a professional Licensed Loan Officer (NOT A BANK), review your complete application for an accurate quote.

St Paul, MN: Virtually, all homeowners have lost value on their homes in recent years. For many, this has created some challenges to refinancing and taking advantage of today’s super low mortgage interest rates.

There are a few programs with can help, depending on what type of mortgage loan you have today. May people have successfully used program like HARP (Home Affordable Refinance Program), the FHA Streamline Refinance, or even the VA Streamline refinance known as an IRRRL loan.

Sadly, not everyone fits the criteria. Therefore Washington has been floating the idea of an expanded HARP 3 Refinance Program. It doesn’t exist yet, and may never exist… But if it does, here is what it may look like:

There are some basic criteria for the #MyRefi or HARP 3 refinance program:

This new HARP 3 refinance program proposal mirrors the current HARP 2.0 refinance loan program (possible no appraisal, less document, etc), except it would potentially also allow any underwater home owner, not just those who have a loan owned by Fannie Mae or Freddie Mac.

Try out the governments “Would I qualify for a refinance” below..

Minneapolis, MN: Home mortgage loans defaulted at a higher rate in the last quarter of 2012. This is unwelcome news compared to an overall trend of good news in the housing and real estate market

Homeowners defaulting on the home mortgage loans has increased for three consecutive months after hitting a post-recession low in September, according to a recent report. Mortgage defaults averaged1.36 percent of all loans in September 2012. Since then, defaults on home mortgages rose to 1.47 percent in October, 1.58 percent in November and 1.68 percent in December.

Homeowners defaulting on the home mortgage loans has increased for three consecutive months after hitting a post-recession low in September, according to a recent report. Mortgage defaults averaged1.36 percent of all loans in September 2012. Since then, defaults on home mortgages rose to 1.47 percent in October, 1.58 percent in November and 1.68 percent in December.

Experts are confused as to why this is happening, as the general housing market has been improving. Foreclosures have been on the decline. New homes sales are up, and with the continuance of historically low mortgage interest rates, first-time home buyers have been snapping up low priced real estate for some time now.

2012 showed a nice improvement in the quality of consumers loans, like cars and credit cards, but first and second mortgage loan defaults have been holding the overall default rate up.

Minneapolis, MN: Freddie Mac yesterday released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates moving higher following December’s employment report. The 30-year fixed averaged 3.40 percent, its highest reading in eight weeks. The all-time record low for the average 30-year fixed was 3.31 percent set November 21, 2012.

Minneapolis, MN: Freddie Mac yesterday released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates moving higher following December’s employment report. The 30-year fixed averaged 3.40 percent, its highest reading in eight weeks. The all-time record low for the average 30-year fixed was 3.31 percent set November 21, 2012.

News Facts

Quotes

Attributed to Frank Nothaft, vice president and chief economist, Freddie Mac.

“Fixed mortgage rates increased slightly following a positive employment report for December. The economy added 155,000 jobs, above the consensus market forecast, and November’s job growth was revised upward by another 24,000 workers. This helped keep the unemployment rate steady at 7.8 percent, the lowest since December 2008. For all of 2012, 1.86 million jobs were created and represented the largest annual gain since 2006.”

Freddie Mac’s survey is the average of loans bought from lenders * last week, including discount points. Applicants must pay all closing costs at these rates. No cost loan rates higher.

Follow this link to view today’s best MN and WI mortgage interest rates.

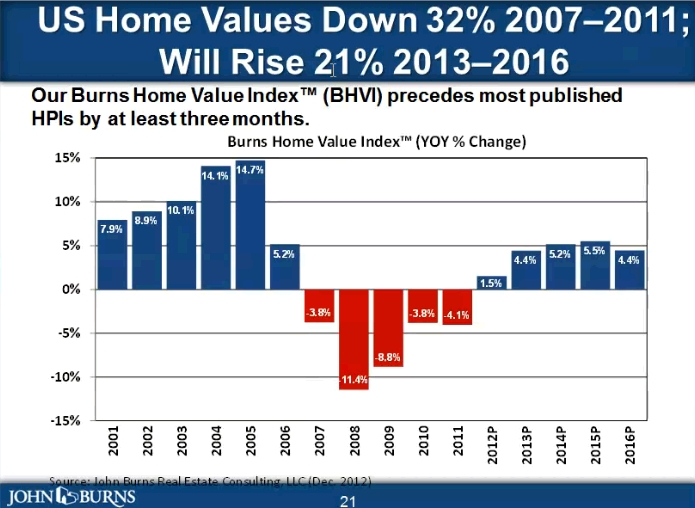

Minneapolis, MN: Homes values have certainly seen a roller-coaster ride. The big run up in from 2000 to 2006, then the crash.

The big question in everyones mind, is what will happen to values in the future? Looking at the chart below, you can see an anticipated rise of 21% in values by 2016.

This is great news all around. Those with existing homes who have lost value should regain a lot. Those buying at today’s rock bottom home prices, and rock bottom low interest rates should see nice appreciation.

What clients and Real Estate Agents Don’t Understand About Appraiser Independence

Minneapolis, MN: Real Estate Agents constantly call our mortgage office to ask if an Appraisal was ordered, or if it is completed yet.

The first question is pretty silly… Of course it was. The second question is tougher to answer until the completed appraisal physically shows up on the lenders desk.

The first question is pretty silly… Of course it was. The second question is tougher to answer until the completed appraisal physically shows up on the lenders desk.

Recent lender rules require what is known as “Appraiser Independence”. This is a double down on the old rules that no one is allowed to influence or pressure the appraiser to obtain any pre-determined value on the home. The rules also means that no one who will be compensated on the file can have anything to do with picking the appraiser. It has to be totally blind and randomly assigned. This is very different from years past where the client or the Loan Officer could pick any appraiser they wanted.

Once the appraisal has been ordered, there are varying degrees of what the Loan Officer may or may not know about the status of the appraisal. Most mortgage companies use a middle company, known as an AMC, or Appraisal Management Company, to handle all aspects of the appraisal. This easily means the lender will meet the “independence” guidelines. Some AMC’s are better than others in letting the lender know the status, giving them the expected date the appraiser will visit the property, and the expected appraisal completion date. With many others, the lender is completely in the blind. In the vast majority of cases, I don’t even know who the appraiser is until the appraisal is completed.

To further complicate the issue, while it is technically possible for a Loan Officer to speak to an appraiser on a very limited number of questions, the vast majority of lenders completely forbid this contact to avoid even the remote likelihood of influence complicity. It is much easier to respond to regulators that “our loan officers are forbidden”, then to claim they didn’t do anything wrong.

As a mortgage lender, it is very frustrating when real estate agents constantly bombard me with appraisal question. If I know, I will tell you. Do not yell at the Loan Officer if they don’t know the answer or say they can not talk to the appraiser.

Successful house hunting starts with mortgage pre-approval – Not talking to a Real Estate Agent.

Minneapolis, MN: Mortgage pre-approval is what happens when you talk to a Loan Officer and find out how much house you can afford. It’s an important step because it helps your real estate agent zero in like a laser beam on the correct house price for you. Your mortgage consultant will ask questions about your financial situation, including job, income, assets, debts, and more. Then you’ll talk to them about your comfort level when it comes to a monthly mortgage payment. It’s important to know this, in order to avoid buying a home you really can’t afford.

At this point, you are NOT pre-approved. The next step to full pre-approval is submitting all your documents to the lender. Common items include; photo ID, pay stubs, W2’s, and bank statements. Once the mortgage company reviews these documents, THEN you will be pre-approved!

Here’s a look at some of the benefits to getting pre-approved before you house hunt:

Mortgage pre-approval is as close as anyone can get to insuring you’ll be able to obtain a mortgage loan in advance of finding a home. Pre-approval gives MN and WI first time home buyers a definite idea of what they can afford and shows sellers that they are dealing with a serious buyer.