FHA Refinance

Homeowners enjoy the benefits of investing in their property year after year. For some, there comes a time when that investment can come in handy. Refinancing with an FHA loan can prove to be an effective way to put that equity to work. Keep in mind that FHA refinancing is only available to homeowners who are currently using their home as their principal residence.

FHA options to homeowners who are considering an FHA refinance mortgage:

This refinancing option is especially beneficial to homeowners whose property has increased in market value since the home was purchased. A Cash Out refinance allows homeowners to refinance their existing mortgage by taking out another mortgage for more than they currently owe.

This refinancing option is considered streamlined because it allows you to reduce the interest rate on your current home loan quickly and oftentimes without an appraisal. FHA Streamlined Refinance also cuts down on the amount of paperwork that must be completed by your lender saving you valuable time and money.

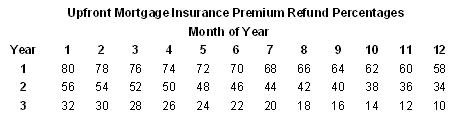

FHA Up Front Mortgage Insurance Premiums (UFMIP)

FHA has recently made changes to the required mortgage insurance. June 11, 2012 is the date FHA Up Front Mortgage Insurance Premiums (UFMIP) will be lowered for some borrowers applying for FHA Streamline Refinance Loans. An FHA Mortgagee Letter 12-4 explains the changes, which affect some, but not al, FHA streamline refinancing loans:

For all FHA Streamline Refinance transactions that are refinancing existing FHA loans that were endorsed on or before May 31, 2009, the UFMIP will decrease from 1.75 percent to just 0.01 percent of the base loan amount.

Basically, those borrowers who have an FHA home loan for a single-family property that was endorsed on or before May 31, 2009 are eligible for a lower rate on their Up Front Mortgage Insurance Premiums. It’s important to note that this rule applies only to those with an FHA Streamline refinancing loan with a case number assigned on or after June 11, 2012.

The same mortgagee letter contains another announcement; “Decrease to Annual Mortgage Insurance Premium on Certain Streamline Refinance Transactions”. In this message, the FHA states, “For all Single Family Forward Streamline Refinance transactions that are refinancing FHA loans endorsed on or before May 31, 2009, the Annual MIP will be 55 basis points, regardless of the base loan amount.”

These two items make for a very significant savings on FHA streamline refinance transaction here in Minnesota, Wisconsin, and the rest of the country.

One other item. It’s important to remember that the FHA does not regulate FHA streamline mortgage interest rates or set them in any way except to state that such rates must be reasonable and customary according to the housing market in that area. Borrowers should expect to negotiate interest rates with the lender and/or comparison shop for the best rates and terms.

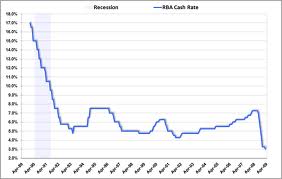

Mortgage Rates are at Historic Lows. Start saving money now on your VA Home Loan!

Mortgage Rates are at Historic Lows. Start saving money now on your VA Home Loan!

Simply put, the lowest rate & the lowest fees do not go hand-in-hand. NO LENDER can offer both together. I can give you rock bottom rates, but it will cost you in fees. I can give you the lowest fees, but it will cost you in interest rate. Most lenders quote their best rate in combination with covering all third party fees (appraisal, credit report, title company, state taxes, county recording fees, etc) with 1% origination. See the example below.

Simply put, the lowest rate & the lowest fees do not go hand-in-hand. NO LENDER can offer both together. I can give you rock bottom rates, but it will cost you in fees. I can give you the lowest fees, but it will cost you in interest rate. Most lenders quote their best rate in combination with covering all third party fees (appraisal, credit report, title company, state taxes, county recording fees, etc) with 1% origination. See the example below.