When buying a condo, there is an extra step many home buyers may not understand that can effect the loan.

Lenders will credit qualify the home buyer, and of course do an appraisal review of the property. But with any condo, the lender also needs to review the association. This is done on all loans, including conventional, FHA, and VA.

If the buyer is using an FHA Loan, the condo or townhouse will need to have prior FHA Approval. If a condo association is not FHA approved, it could indicate a problem with the association that could make getting financing in that complex hard or even impossible.

How do I verify a condo association is FHA approved?

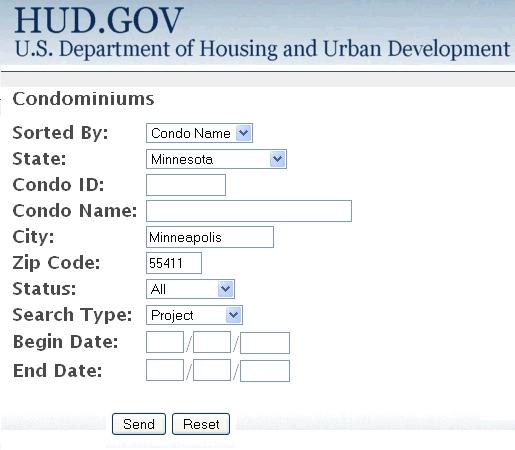

It is actually rather simple. Simply go to the FHA condo website at https://entp.hud.gov/idapp/html/condlook.cfm.

I find it best to search by city or zip code rather than association name. It is the easiest way to get a positive search result.

If the complex is not listed, then it is not approved. If the association not approved, the association needs to get the approval. There is nothing the buyer can do on their own to get the association FHA Approved.

Many times, this forces the potential buy to switch to a conventional loan. Conventional loans also need condo association approval, but on conventional loans, there is also a pre-approval process. But is the complex is not pre-approved, there IS case-by-case process on conventional loans.

A townhouse may actually be a condo

It looks like a town home, it acts like a town home, but it may legally be a condominium. Don’t assume. Be sure to check with your Realtor or the Association itself. A good rule, but not always is hidden in the legal description. If it says “Lot and Block”, it is most likely a town home. If is says “CIC” or Common Interest Community, then it is likely a condo.

Do you already live in a condo that is not FHA Approved?

If you already live in a condo and the association is NOT approved, you should attend the next association meeting to talk about getting the complex approved. Frankly, the lack of an FHA approval means less buyers can buy in your complex, therefore significantly reducing the value of your unit. It doesn’t cost very much, and is not very difficult for the association to get FHA approval.