Mortgage Compliance Rules – Like a big monkey on your back. While the rules are well intended… It just doesn’t work on the street when government do-gooders interfere in an industry

Joe Metzler

Joe Metzler

Mortgages for Self-employed about to be even harder to obtain

If you’re self-employed or own a small business, getting a mortgage will become a whole lot harder soon.

Beginning in January, new lending rules go into effect that might make it more difficult for a small-business owner or self-employed individual to buy a house or refinance an existing mortgage.

READ THE FULL STORY at Deleware Online

What is your home worth? Find out for free…

What’s the value of your home? (MN & WI Only)

What’s the value of your home? (MN & WI Only)

Many homeowners are curious about the appraised value of their home. An actual appraisal is expensive, and county tax records do NOT always reflect true market value. As you may be aware, home values are constantly fluctuating, and with the decline in average values, everyone has lost value.

But things are changing, average home values the past 12 months in the Minneapolis / St Paul, MN area have risen on average 14.1%. So what your home is worth today?

There are many sites that claim to give you are idea, including Zillow, Trulia, and more. It is also a well known fact those sites have very questionable data, giving values that range from close, to crazy far off. The big problem is, where is the data they use coming from and how accurate is it?

We have a different tool to answer the estimated appraised value of your home question. Our system uses the Freddie Mac Home Price Index ( FMHPI ). FMHPI is calculated using a repeat-transactions methodology. Repeat transactions indexes measure price appreciation while holding constant property type and location, by comparing the price of the same property over two or more transactions. The change in price of a given property measures the underlying rate of appreciation because basic factors such as physical location, climate, housing type, etc., are constant between transactions. Averages of appreciation rates for different geographic areas and time periods are calculated using statistical regressions and the index values are derived from these averages

While the estimate may not be the actual or appraised value of your property, this can be a much more useful too than Zillow to gauge fluctuations and trends in your market which affect your home’s value.

Want to check your homes value? Simple click the link below! (MN and WI homes only)

De-Bunking 3 Mortgage Myths

I hear things all the time, that as a Minnesota Based Mortgage Loan Officer, drive me crazy. Here are a few things that seem to be high on the need to be de-bunked list.

Myth #1 – Banks are not lending.

NOT TRUE: We are very busy! Mortgage companies continue to see a record number of home buyers applying and qualifying for mortgage loans, and refinance loans are still popular with our current low mortgage rates. BAD credit loans are not available, so I suppose if you are a bad credit customer, yes, banks are not lending to you.

Myth #2 – APR & Interest Rates are the same thing / Shop by APR

Myth #2 – APR & Interest Rates are the same thing / Shop by APR

NOT TRUE: The interest rate is the price you pay to borrow money. APR (annual percentage rate) includes other fees that you may have financed into your mortgage loan, like closing costs and mortgage insurance. Don’t be fooled when shopping for a mortgage. When the rate is below everyone else, you are likely paying higher closing costs and discount points to “buy” that rate. Paying discount points is a personal decision based current cash flow, time in the property, loan-to-value, and more. Talk to your Minnesota mortgage lender to determine what financing options are best for your specific situation.

Myth #3 – You can be pre-approved for a mortgage without submitting documents.

NOTE TRUE: If you’ve been told you that are pre-approved for a mortgage loan, but you never sent W2’s, pay stubs, bank statements, etc to the lender, YOU ARE NOT PRE-APPROVED, regardless of what they tell you.

Disputed Items on Credit report Killing your Mortgage Application

Minneapolis, MN: It is a fairly common practice recently, and people with credit report issues are told to do it on a regular basis, but disputing an item on your credit report may just end up getting your mortgage application denied!

Disputing bad credit really is the the heart of credit repair, but mortgage underwriting system have been improved and upgraded to deal with this issue. All mortgage loans start out by being run thought an automated underwriting system (AUS). The AUS looks at your overall application and your credit report to make a lending decision.

Disputing bad credit really is the the heart of credit repair, but mortgage underwriting system have been improved and upgraded to deal with this issue. All mortgage loans start out by being run thought an automated underwriting system (AUS). The AUS looks at your overall application and your credit report to make a lending decision.

Having disputed items on your credit report will prevent an automatic approval, and force your loan to be down graded to an manual underwrite. It doesn’t matter if your score is acceptable.

A manual underwrite on your mortgage application is DRAMATICALLY more restrictive in guidelines than an automatic underwrite. You will be required to pay off collections, supply more documentation, and the whole process will take longer!

A good example would be debt-to-income ratios. On a computer approval, you may be approved with a 45% debt ratio. But if it a manual underwrite, it is 41% of bust.

I just had this occur to one of my clients (which is why I am writing this post). The client has an old car repo on his credit report with a $10,000 deficiency balance. With the computer approve, he would NOT have to pay the old item off to buy his house. Unfortunately, he tried disputing the repo and hoped it would magically go away. Well, it didn’t – and shouldn’t. So the dispute on the credit report turned his application into an manual underwrite, and under the manual underwrite guidelines, he MUST PAY IT OFF in order to buy his house. Ouch…

New FHA Rules – 3 major changes coming soon

Minneapolis, MN: If you are a first-time home buyer, you may already be leaning towards an FHA-backed mortgage to finance your Minnesota or Wisconsin home. Recently, the Federal Housing Administration announced changes to their mortgage guidelines, which are being made to stem the losses from all the foreclosures the past few years.

FHA does not provide loans, rather FHA is a government entity that insures mortgage loans made by banks and non bank lenders. Needless to say, if a lender can get an FHA guarantee on a portion of a loan, they are much more willing to provide a loan to someone.

FHA does not provide loans, rather FHA is a government entity that insures mortgage loans made by banks and non bank lenders. Needless to say, if a lender can get an FHA guarantee on a portion of a loan, they are much more willing to provide a loan to someone.

Without the FHA, home buying would be a bit tougher for many home buyers buyers who cannot meet the slightly higher down payment and credit score requirements of a conventional loan. After the collapse of subprime lending in 2008, and the tightening of credit that followed, FHA-backed mortgages became the only game in town for many first-time home buyers.

FHA guidelines are a little more forgiving when it comes to credit history, making it the only practical option for some home buyers who had a prior bankruptcy, foreclosure, or short sale in the past few years.

Here are 3 major FHA rule changes slated for 2013, and how they may affect you:

1. All FHA loans initially require mortgage insurance. Just like conventional loans, mortgage insurance could be dropped below 80% loan-to-value. After June 3rd 2013, this is no longer the case. Mortgage insurance on FHA loans will be on your mortgage payments for the life of the loan.

2. The cost of monthly mortgage premiums is going up slightly on April1, 2013. While it is a relatively small amount; it would add an extra $20 a month to a $200,000 mortgage. This will only effect new loans.

3. Few lenders allow for score below 640, but for those lender who do offer very poor credit score FHA loans (580-620 range) home buyers will face stricter debt-to-income ratios in 2013. In other words, the less debt you have, the better.

The good news is, these changes shouldn’t derail anyone’s plans to buy a home in MN, WI, or the rest of the country. Even with the new changes in 2013, FHA-backed mortgages remain attractive for many at least for the first 10-years or so of home ownership.

Finally, if you are buying a home, remember to get pre-approved by a local Minnesota or Wisconsin mortgage lender first… You need to know what loan programs you qualify for, down payment options, FHA mortgage interest rates and how they will effect you, and an acceptable price search range to be looking at BEFORE you spend any time with a Realtor.

FHA Streamline refinance in MN and WI

The FHA Streamline Refinance program.

No appraisal, no closing costs, easy qualifying, and even skip a month of payments.

For FHA properties in Minnesota or Wisconsin, Apply online today

at www.FHA-Streamline-Refinance-MN.com

Alternatives to Foreclosure

Minneapolis, MN: Life happens. For all sorts of reasons, from divorce, job loss, or a major medical event, people can sometimes get into financial trouble. The worst thing anyone can do is bury your head in the sand. It isn’t going away, and is usually easier to deal with early on. Ask friends and relatives for help right away.

Other Alternatives to Foreclosure

Other Alternatives to Foreclosure

Reinstatement

A reinstatement is the simplest solution for a foreclosure, but often the most difficult to achieve. The homeowner simply comes up with the money to pay the total amount past due (including late fees) to the lender. This is a great option early on.

Bankruptcy

Many believe bankruptcy is a “foreclosure solution,” but this is only true in some states and situations. Entering bankruptcy can be a risky and costly process. Be sure to seek the advice of a qualified bankruptcy attorney when pursuing this as an option.

Refinance

Refinancing means you will acquire a new loan based on your current credit standing. If you have already missed mortgage payments, those missed payments and now damaged credit scores may make it difficult to get approved for a new mortgage loan

Mortgage Modification

A mortgage modification involves the reduction of one of the following: the interest rate on the loan, the principal balance of the loan, the term of the loan, or any combination of these. Contact your current lender to discuss a modification.

Deed-in-Lieu

Also known as a “friendly foreclosure,” a deed-in-lieu allows the homeowner to return the property to the lender rather than go through the foreclosure process. Contact your lender on how to “give back the keys.”

Forbearance

A forbearance or repayment plan involves the homeowner negotiating with the mortgage company to allow them to repay back-payments over a period of time. Typically this involves putting the past due payments to “the back of the loan.”

Short-Sale

A short-sale is exactly what the name implies. You put the home up for sale, and find a buyer. Unfortunately, the sales prices is less than you owe. You will then negotiate with the bank to accept the sales prices as payment in full. While still damaging to your credit, it is better because you usually are able to walk away free… with the bank never coming after you for any money they lost. On a true foreclosure, they can usually come after you later on for any loss.

Rent the Property

This option does not require lender approval, but does require the homeowner’s ability to rent the house for enough money to cover the monthly mortgage payment. Being a landlord isn’t overly difficult, but isn’t for everyone.

Service members Civil Relief Act

If a member of the military experiences financial distress due to deployment-and their debt was entered into prior to deployment-he or she may qualify for relief under the Service members Civil Relief Act.

Getting a VA Home Loan in MN or WI

Minneapolis, MN: VA Home Loans In MN and WI are probably the coolest mortgage loan lenders offer.  It is available both while serving our country and after they are discharged.

It is available both while serving our country and after they are discharged.

Upon a veterans return, hey usually are looking to re-establish themselves the the communities that they will be returning to. This means that many of them will be looking to purchase a home that they can settle in and raise their families. A VA Mortgage can assist our Veterans in making that transition.

VA Mortgages provide our Veterans with two major advantages that other Mortgage programs do not have.

VA Loans require no down payment, and have no mortgage insurance, plus you can roll all your closing costs into the loan. This makes for one heck of a great first-time home buyer deal for military veterans wanting to buy a home! The country appreciates your service. This is one way we pay you back. Today mortgage rates on VA loans are very low, making homes even more affordable.

VA Mortgage benefits for a Veteran:

- No down payment up to $417,000 for most of the country

- No expensive mortgage insurance

- Loan amounts over $417,000 (with some down payment)

- Assumable mortgages

- Streamline Refinance program (VA IRRRL Loan)

A VA Streamline Refinance is similar to the FHA Streamline Refinance. It is officially known as a IRRRL loan (interest rate reduction refinance loan) because of the money you can save by lowering your monthly interest rates. It was created by the VA in an effort help our veterans secure the lowest interest rate possible. This VA loan process is done quickly, with minimal hassle so our veterans can save immediately.

Those who are eligible:

- Honorably discharged

- Widow/widower of eligible service member or spouse of an MIA or POW

- Wartime service – a minimum of 90 days active duty

- Peacetime periods – 181 days of continuous active duty

- Actively in service or a valid VA Form DD214

- Have certificate of eligibility (I can usually get this for you)

Mortgage Rates unchanged for week ending Feb 14th 2013

Minneapolis, MN: Freddie Mac yesterday released the results of its most current Primary Mortgage Market Survey(R) (PMMS®), showing average fixed mortgage rates unchanged from the previous week and remaining near their record lows as they continue to support housing demand, translating into a pick-up in home prices in most markets.

- 30-year fixed-rate mortgage rates (FRM) averaged 3.53 percent with an average 0.8 point for the week ending February 14, 2013, the same as last week. Last year at this time, the 30-year FRM averaged 3.87 percent.

- 15-year fixed mortgage rates this week averaged 2.77 percent with an average 0.8 point, the same as last week. A year ago at this time, the 15-year FRM averaged 3.16 percent.

- 5-year adjustable rate mortgages (ARM) averaged 2.64 percent this week with an average 0.6 point, up from last week when it averaged 2.63 percent. A year ago, the 5-year ARM averaged 2.82 percent.

Freddie Mac’s survey is the average of loans bought from lenders * last week, including discount points. Applicants must pay all closing costs at these rates. No cost loan rates higher.

Follow this link to view today’s best MN and WI mortgage interest rates.

Quotes

Attributed to Frank Nothaft, vice president and chief economist, Freddie Mac.

“Mortgage rates remain near record lows and continue to support housing demand, translating into a pick-up in home prices in most markets. The median sales price of existing homes rose 10 percent between fourth quarter 2011 and 2012, the largest year-over-year gain in seven years. Among large metropolitan areas, 88 percent saw positive annual increases in the fourth quarter, compared to 81 percent in the third quarter and 75 percent in the second. The largest gains occurred in Phoenix (34 percent), Detroit (31 percent) and San Francisco (28 percent).”

Popular FHA Loans to become more expensive

Minneapolis, MN: The popular FHA loans, requiring just 3.5% down payment are about to become more expensive.

Minneapolis, MN: The popular FHA loans, requiring just 3.5% down payment are about to become more expensive.

Starting on April 1, 2013, the mortgage insurance premium will go up by .1% to 1.35%. While this is small, this is the most expensive mortgage insurance of all loans available in the market! This is also on top of the more than doubling of FHA mortgage insurance two-years ago. These staggering increases in mortgage insurance is highly expected to continue the decreased use of FHA loans.

To add insult to injury, on June 3, 2013, FHA mortgage insurance, which currently goes away when your loan-to-value drops to 78%, will be changed to “life of loan”. Another words, it will NEVER go away, regardless of down payment or loan-to-value. This will only be one NEW loans. Existing FHA loans will not change.

Example: Purchase Price $175,000 3.5% down payment at 4% mortgage rate on 30yr. Currently, that mortgage insurance would end at 78%, and cost someone $20,838. Under the new rule, the mortgage insurance would be on the loan forever, and cost someone $42,447 – MORE THAN DOUBLE the cost.

There are buyers that qualify on income and credit who may not have the necessary additional down payment required for the 5%, or 10% down conventional loans. The 3.5% FHA program has provided a great vehicle to get into a home with a minimum amount of cash.

The average time for FHA mortgage insurance to go away is about 9.5 years. So for homeowners who anticipate staying in their home for ten years or less, the new changes might not have much financial impact. However, homeowners who expect to be in their home longer should seriously consider going with a 5% down conventional loan if at all possible.

For buyers currently in the market, you can avoid these increases by acting now.

HARP 3 on the horizon?

Minneapolis, MN: As anticipated, Democratic Sens. Robert Menendez, NJ, and Barbara Boxer, CA, this week reintroduced a bill that could spur more refinances.

The Responsible Homeowner Refinancing Act, (AKA HARP 3) among other things, has a stated goal of relaxing requirements for borrowers to refinance and would extend the Home Affordable Refinance Program (HARP) for an extra year through 2014. It is currently set to expire December 31, 2013.

The Responsible Homeowner Refinancing Act, (AKA HARP 3) among other things, has a stated goal of relaxing requirements for borrowers to refinance and would extend the Home Affordable Refinance Program (HARP) for an extra year through 2014. It is currently set to expire December 31, 2013.

Currently, the HARP Refinance program only allows people who have a loan owned by Fannie Mae or Freddie Mac to refinance an underwater home. HARP 3 would allow ALL underwater homes to be refinanced.

Stay tuned for more details.

Hurt an Intruder? Are you insured?

St Paul, MN: I just ran across this issue, and thought it was interesting to pass along.

Suppose a thief breaks a window in Joe McHomeowners home and crawls through. Joe McHomeowner, the insured, uses a baseball bat to knock out the intruder and then calls the police.

Suppose a thief breaks a window in Joe McHomeowners home and crawls through. Joe McHomeowner, the insured, uses a baseball bat to knock out the intruder and then calls the police.

In today’s world, it is likely the thief will sue for his injuries. Is Mr McHomeowners liability for the thief’s head injuries covered by his homeowners policy?

The answer is YES. Joe McHomeowner’s liability is covered because he used reasonable force to protect persons and property.

When buying a home, be sure you get proper homeowners insurance. A great policy is usually only a few dollars more per month over cheap insurance. Be sure to talk with a licensed insurance agent – not just a web site – to make sure you are fully and properly covered on your home.

Beware of Online Homeowners Insurance

What do you know about Insurance?

St Paul, MN: What do you get with a online insurance provider like Progressive, Esurance, or Geico?

Well they tell you they have a great price, but come on, what insurance ad have you ever seen that doesn’t promise that. We think the much more important issues are knowledge and coverage. Do you really think their national call centers, filled with order takers trying to help you complete your online quote, really know anything about it?

A great example is the number of people in MN who carry the minimum state required auto insurance coverages of 30/60/10. It is the cheapest coverage, but leaves you grossly under-protected. If you talked with a real live insurance agent, they could explain that poor coverage… But more importantly, explain how for usually around just $100 more a year, you could move up to awesome insurance coverage.

As you evaluate coverage and providers, ask about why you need higher limits as a homeowner, or when you have young drivers, or higher liability limits when you have a dog, trampoline, or pool?

These are all great reasons why you want to talk to an agent that lives, works, and understands the local Minnesota insurance market and can advise and help you make the right decisions.

These are important decisions. There isn’t much point in saving $20 a month if you end up owing for a loss of $40k or $50k that should have been covered but isn’t! Talk about MAYHEM.

On top of that, talking with a live insurance agents usually save people money over these online order centers to boot. Don’t let your friends and family get duped by all the hype and commercials.

Have them call a local insurance provider like The Reliable Insurance Network for a quote and get real service along with a great price.

Shopping for an Interest Rate?

Minneapolis, MN: Thinking of refinancing your home? Are you a First Time Home Buyer? Homeowners have thousands of choices when it comes to shopping for their mortgage loan, and sometimes all these options can spell trouble.

Pretty much every phone call I take starts with “What’s your interest rate?” While this seems like a very logical question to ask, it doesn’t give the lender all the information needed to give you an accurate answer.

This goes for online mortgage interest rate search tools too. While you may put in some basic information, I haven’t seen a system yet (including ours) that could ever replace a actual Loan Officer and be 100% accurate.

This goes for online mortgage interest rate search tools too. While you may put in some basic information, I haven’t seen a system yet (including ours) that could ever replace a actual Loan Officer and be 100% accurate.

There is no generic rate: A common misconception is there is a “rate”… We’ve all hear the commercials… “The rate today on a 30-yr fixed is ____, and only at so and so company.” I cry foul! The only way you can ever get an accurate interest rate quote is to supply a mortgage company with a complete application, and the lender also reviews a credit report.

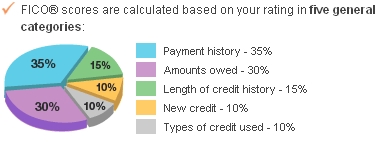

Credit Score: To accurately quote you an interest rate, a lender has to run your credit to determine your credit score. Interest rates can vary greatly on some programs depending on credit score. Most loan programs have pricing adjustments based on credit score, so without looking at your credit, any lender quote is just guessing. While I like to believe what people tell me, until I see for sure, it doesn’t mean anything. I can not tell you how many times someone has said “I have excellent credit,” (which is a 740 middle credit score or higher), so I quote them based on that score, only to actually review their credit the next day to find out their score is a 700. On some programs, the difference between a 740+ score, and a 700 score could mean as much as 1/4% (.25) higher interest rates!

There are at least 21 criteria that goes into determining your interest rate. Here is a small sampling:

- Credit score

- Loan program

- Loan Size

- Down Payment (or equity position)

- Owner-Occupied or Investment

- Closing cost options

I consistently hear, after I’ve taken a full application and accurately quote a client “That’s different than I saw (online, in the news paper, on TV).” The general attitude is that my quote is high. The reality is you are usually comparing an accurate quote against teaser advertising rates, or rates that do not apply in your situation.

So be mindful of the difference between advertising and reality. Let a professional Licensed Loan Officer (NOT A BANK), review your complete application for an accurate quote.